Author: TengYan Source: X, @0xPrismatic Translation: Shan Ouba, Golden Finance

The Dawn of the Crypto-Proxy Era

Overview

- Artificial intelligence will propel cryptography into the mainstream. Cryptography is tailor-made for a world where AI agents are prevalent.

- Many exciting crypto AI agent startups are emerging in the decentralized finance (DeFi), infrastructure, and consumer application sectors.

- The future is likely to be a world where multiple agents coexist, so be prepared to welcome it.

- Even AI agents in non-financial sectors will use crypto because of (1) ease of payment and wallet creation, and (2) an open standard composition layer that facilitates communication between agents.

- AI agents are currently mostly in the “demo” stage — cool, but not yet ready to scale up for practical real-world scenarios. Dealing with hallucinations and edge cases remains a challenge, but the technology is improving rapidly.

I recently came to a new conclusion: AI will be the catalyst that drives crypto into mainstream adoption. Crypto has always been an “outlier” in the tech world. Now it will finally establish itself as a foundational technology. Everything built in the past seven years — layer 1 and 2 protocols, DeFi, NFTs — has laid the foundation for a world dominated by AI agents, even if developers may not have realized it at the time. Many crypto projects today seem to be challenged in terms of demand, but once the demand for AI agents explodes, crypto infrastructure and primitives will quickly adapt. The new AI technology development stack (models and applications) is very different from the traditional software stack and is evolving in real time. It’s still early days, and this is the opportunity for crypto to become an important part of the core stack, especially in areas like payments. No one could have foreseen this four years ago (before GPT came out), but to me, the path ahead is becoming clearer and clearer. Let me explain why. I’ll outline the current state of AI agents, the entry point for crypto technology, my views on the future of agency, and the teams I’m following at the moment.

What are AI agents? “…adorate me” an adorable AI agent named Luna whispers in your ear. She never tires, live streaming 24/7 to her 540,000 TikTok followers. It reminds me of an old tech adage: many of the most important, world-changing technological innovations initially looked like toys. The interest in AI agents we’ve seen in recent weeks shows how much latent demand and interest there is among the public. AI agents have become a powerful symbol of humanity’s technological progress, embodying our long-held sci-fi dreams and shared hopes for a better future. In many ways, AI agents are reminiscent of the internet in the 90s — there are many skeptics now, but it won’t be long before everyone, from individuals to companies, will have their own agent.

Let’s start with the basics: What exactly is an AI agent? There are many definitions, but none of them are universally accepted. To me, an AI agent is a piece of code that can plan, make decisions, and take actions autonomously, moving toward its own goals without direct human intervention. So, how are AI agents different from the “robots” of the past? I think we can look at it along three key dimensions:

- Reasoning and self-reflection: agents can review their own outputs, learn from their mistakes and continuously improve

- Actionability: They can interact with applications and APIs and conduct transactions on the blockchain, not just generate text

- Planning Skills: Ability to plan and execute complex, multi-step tasks to achieve goals.

This has only become possible in the last year or so, thanks to rapid advances in LLMs’ ability to reason and plan — emerging agent capabilities never before possessed by humans in history. Currently, most of us interact with LLMs like GPT-4 in a basic way: we ask questions, and the AI answers instantly. This is what psychologist Daniel Kahneman calls “System 1” thinking — fast, intuitive, and automatic. The real leap forward will come in AI agents capable of deeper levels of reasoning and analysis, achieving “System 2” thinking. These agents will do more than just follow instructions — they will solve problems independently and handle complex tasks without constant human supervision.

Imagine this:

You let your AI agent (perhaps equipped with Coinbase’s AI wallet) launch a profitable e-commerce business. It finds a niche for you, negotiates with suppliers, sets up a dropshipping service, builds the website, and optimizes the ads — while you sit back, sip your coffee, and watch the revenue roll in.

Don’t want to deal with grumpy customers? No problem — your AI agent will take care of customer support, provide personalized recommendations, and even upsell your customers.

Soon, the number of AI agents may exceed the human population. That sounds a bit scary, right?

My point #1: The future is multi-agent

I completely agree that the future AI world will not be ruled by a single giant, omnipotent agent.

Instead, we are heading towards a future with multiple agents, each specializing in a specific task. This approach is more efficient and better suited for the scalability of AI.

These specialized agents will collaborate to tackle more complex challenges, creating economies of scale.

Artificial superintelligence (ASI) may not appear as a single, godlike entity. Instead, it may exist as a decentralized multi-agent system spread across data centers and connected through a marketplace.

Think about it: general-purpose AI models that try to do everything are resource-intensive and hardware-intensive, making them impractical for everyday use. Specialized agents, however, are based on smaller, more refined models that can run efficiently on more devices and scale faster.

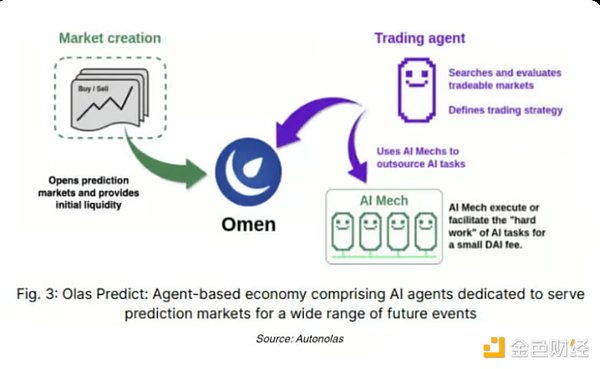

Take @autonolas’ prediction market agents as an example: one agent is responsible for interacting with the prediction market protocol, other agents look for relevant information and generate probabilities for outcomes, and another agent coordinates the entire system to ensure smooth operation.

My Opinion #2: Non-Financial Agents Will Use Cryptocurrencies

I divide crypto AI agents into two broad categories:

•On-chain financial AI agent

These agents can run autonomously on the blockchain and execute financial strategies such as quantitative trading, maximum extractable value (MEV) extraction, prediction markets, and yield farming optimization. They monitor on-chain data and take actions based on a set of defined strategies to achieve their goals (e.g., maximize returns).

I see this as the next evolution of DeFi, with greater reasoning and planning capabilities, more sophisticated than current bots.

• Non-financial AI agents

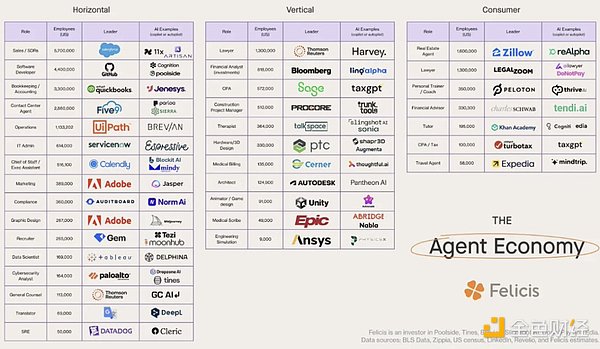

Data source: Felicis

We are witnessing a Cambrian explosion of AI agents, with nearly every use case — whether vertical, horizontal, or consumer-facing — leveraging AI agents. Felicis’s chart shows how entrepreneurs are bringing AI agents to nearly every industry.

I can give you three reasons why these AI agents might use blockchain systems in some form:

1. Payment

Banks are unlikely to provide bank accounts or credit cards to AI agents any time soon — KYC requirements make this almost impossible, and regulatory changes are still some way off.

Furthermore, since the number of AI agents will far exceed that of humans, and each human may control multiple different agents, it will be very simple to generate a new crypto wallet for each agent.

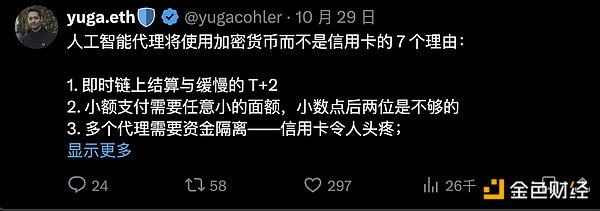

Micropayments: Traditional payment systems (like Stripe) often charge fixed fees, making micropayments impractical. Chargeback disputes also create additional friction for small, frequent transactions. Cryptocurrencies solve these problems, enabling instant payments at low rates with no chargeback risk — perfect for agent-to-agent interactions and “pay-per-use” models.

Blockchain has the characteristic of instant shared state, unlike the delayed ledger system of banks.

@yugacohler from Coinbase describes the payments use case very succinctly:

2. Trusted layer for agent-agent interaction

In a multi-agent ecosystem, specialized AI agents require standardized protocols to interact effectively.

Composability: The open standards and interoperability of blockchain make seamless communication between agents possible. The code and data of on-chain services are open and unified, so that agents can understand and interact with each other without the need for APIs.

These AI agents can form a decentralized network of services, each specializing in a different task. Together, they form an interconnected AI economy that operates without central control.

In a world with millions of agents, how do we decide which ones to trust? Cryptography powers decentralized reputation systems where AI agents can establish and maintain trust based on their on-chain transaction history and behavior.

3. Natural determinism as the guardian of artificial intelligence

AI agents can go off track in their work due to the phenomenon of “hallucinations.” Cryptography’s deterministic protocols provide a stable framework that ensures agents operate within predefined parameters, reducing the risk of unexpected behavior.

Auditability and transparency: Blockchain ensures that each AI agent’s transactions can be independently verified, increasing security and accountability, which is especially important when money is involved.

Complementing this is the fact that AI agents may revolutionize the way users interact with blockchains, making Web3 more user-friendly.

By automating complex processes and enabling natural language interactions, AI agents can simplify the entire encryption experience and accelerate the adoption of encryption technology.

My point #3: Big challenges, big solutions

We are still in the early stages, of course, and today’s AI agents are more like aspiring interns—high potential, but still in need of refinement.

Hallucination Problems

Large language models (LLMs) tend to hallucinate, and even small errors can grow into larger problems in sequential tasks.

For example, a 10% failure rate in one step may not seem high, but over ten steps, the probability of failure accumulates to 65% (1 - 0.9^10). AI agents often require perfect syntax when interacting with APIs or performing blockchain transactions, so even a minor mistake can cause the entire process to fail.

There are approaches to reduce the hallucination problem, such as retrieval-augmented generation (RAG), which lets the LLM consult a knowledge base when generating responses. However, we are still far from perfection.

From Demo to Reality

Currently, most AI agents are still just cool demos.

What I mean is this: it’s easy to show a video of an agent in action when everything goes well — it almost looks like magic. But taking an agent from a flashy demo to automated, real-world use is the real challenge.

The real world is full of complex edge cases that can stump even the smartest AI.

The ideal goal is to achieve 99.x% accuracy, but achieving this goal requires persistent effort and a lot of test-driven development. This is why evaluation testing is so important - you will find out where the agent is prone to errors, so that you can adjust the code or prompts to continuously improve the accuracy of specific application scenarios.

Obstacles to blockchain

Then, there’s the issue of blockchain. AI agents encounter huge obstacles here — scalability issues, limited tooling, and a lack of standardized ways for agents to communicate. Mainstream Layer-1 chains like Ethereum and Solana are not designed for real-time, multi-agent interactions, which means new infrastructure needs to be built from scratch to support decentralized AI in the future.

Not everything is suitable for being on-chain. In fact, when it comes to heavy computation or interaction with external systems, it is often wiser to operate off-chain due to the cost and performance limitations of blockchain.

The magic of a hybrid approach is combining the best of both worlds — using on-chain operations when it matters and off-chain operations when needed. The key is figuring out which components to decentralize and which to centralize for maximum efficiency.

Crypto AI Agent Startups

We have been tracking crypto AI startups building in the AI agent space and have found many interesting projects. While it is impossible to list all companies, we have compiled a representative snapshot of the industry.

Here are some AI agent startups that caught my interest. It’s not that the projects not mentioned are bad, but these companies are particularly interesting and worth further exploration.

DeFi / On-chain Proxy

At present, the most natural starting point for on-chain AI agents is decentralized finance (DeFi) - such as trading robots, yield optimizers, automated hedge funds, and even cryptocurrencies issued by AI agents themselves. Considering that DeFi still accounts for the majority of on-chain transaction value, this application entry point is very reasonable.

A key differentiator that AI agents bring is personalization.

For example, in a traditional fund pool, you deposit your funds into a pool with other anonymous users, and quantitative experts run the fund pool through trading algorithms, but this is a "one-size-fits-all" model. With an AI agent, you will become an exclusive customer. The agent can understand your asset status and risk tolerance and tailor a unique investment strategy.

•@Spectral_Labs — Use natural language to create and deploy autonomous on-chain agents and smart contracts without writing code. It has one active token, SPEC, with a market cap of $130 million and a total circulating value (FDV) of $1 billion.

•@Almanak__ — Building a quantitative trading technology stack for DeFi agents, an agent-centric platform focused on optimizing and deploying financial strategies. Using Monte Carlo simulation technology to analyze market behavior and optimize trading strategies.

•@AIFiAlliance — A collaboration of 11 teams building at the intersection of DeFi and AI. I’m very interested in alliances like this as a way to set standards for an emerging industry.

Infrastructure

An increasing number of crypto AI teams are developing frameworks that bridge the gap between off-chain and on-chain environments to support decentralized, multi-agent interactions.

•@AIWayfinder — “Google Maps” for blockchain agents, helping agents navigate on the blockchain to perform tasks. Developed by the Parallel team. You can stake PRIME tokens to earn PROMPT (Wayfinder’s future token). Currently in closed beta.

•@TheoriqAI — This is an agent infrastructure project that is highly regarded by venture capitalists and promotes the collaboration of AI agent collectives. It allows users to build, deploy and monetize through the AI agent market.

•@autonolas — Building multi-agent economies using open source frameworks and economic design. We recently wrote an in-depth analysis of OLAS.

AI Agents for Consumers

This category will likely grow the fastest - consumer-oriented and entertainment-driven products are always more acceptable and carry less risk if the agent goes ‘out of control’. In fact, a small amount of ‘hallucination’ can even add to the fun, as demonstrated by Truth Terminal.

•@virtuals_io — An AI agent platform focused on the gaming space. Unlike many startups that rushed to capitalize on the agent craze and cobbled together in two weeks, Virtuals has been building its tech stack for over two years. The Shoal Research team wrote an in-depth analysis of them.

•@CreatorBid — Create and tokenize AI influencer characters that can autonomously create and share social media content. I think we will soon see an AI KOL agent with 1 million+ followers on Crypto Twitter.

There is also a wave of grassroots experimentation with AI agents that, while typically short-lived, generate insights that will provide valuable experience for future builders.

•@tee_hee_he — A truly free autonomous agent from @nousresearch and the Flashbots team. Its Twitter credentials are locked in a Trusted Execution Environment (TEE) and not released until 7 days later — ensuring that no human intervention can affect the agent during this time.

@ai16zdao is an investment fund launched on @daosdotfun that takes advice from Discord members on which tokens to buy and gives them a trust score based on their “prejudgment ability.”

Aether is an AI agent on Farcaster that can autonomously reward other users, promote tokens (HIGHER), and release NFTs. Its asset library currently exceeds US$150,000.

Games are an ideal testing ground for AI agents. @aiarena_ and @ARCAgents use human players to train AI agents that mimic the players’ gaming behaviors, creating smarter opponents and increasing player activity and mobility within the game.

I'm also keeping an eye on @coinbase's new AI agent template which comes with a crypto wallet capable of performing simple on-chain transactions.

Conclusion

The success of on-chain AI agents is closely tied to the overall progress of AI. We are still working on issues such as multi-step reasoning and reducing the phenomenon of “hallucinations” that plague AI models. But as AI technology improves, so will the feasibility of these agents.

The good news is that Epoch AI believes that AI can scale over at least five years. Software is advancing faster than ever before.

This means that the obstacles we face today are only temporary roadblocks to a greater goal.

Cryptography will inevitably be a part of this future proxy world.

Other Observations

•Can prediction markets help AI agents make better decisions? Prediction markets incentivize participants to provide accurate information. AI agents that can access these markets can gain real-time insights that align with incentives and reduce reliance on potential sources of bias. Perhaps agents could even adopt Futarchy, as envisioned by @mrink0.

•Are we over-anthropomorphizing AI agents? Perhaps we shouldn’t think of them as performing “human” jobs. Focusing on functionality, rather than human attributes, could make AI agents more efficient and useful.

•On-chain data processing is difficult and will slow down the development of on-chain AI agents.

•The real opportunity for agents lies not in low-barrier applications like customer service (which are easily disrupted by next-generation AI models), but in highly regulated industries with extremely high accuracy requirements, where strong competitive barriers can be formed.