Author: BitpushNews

The deal-making frenzy sparked by Trump's victory continues to heat up.

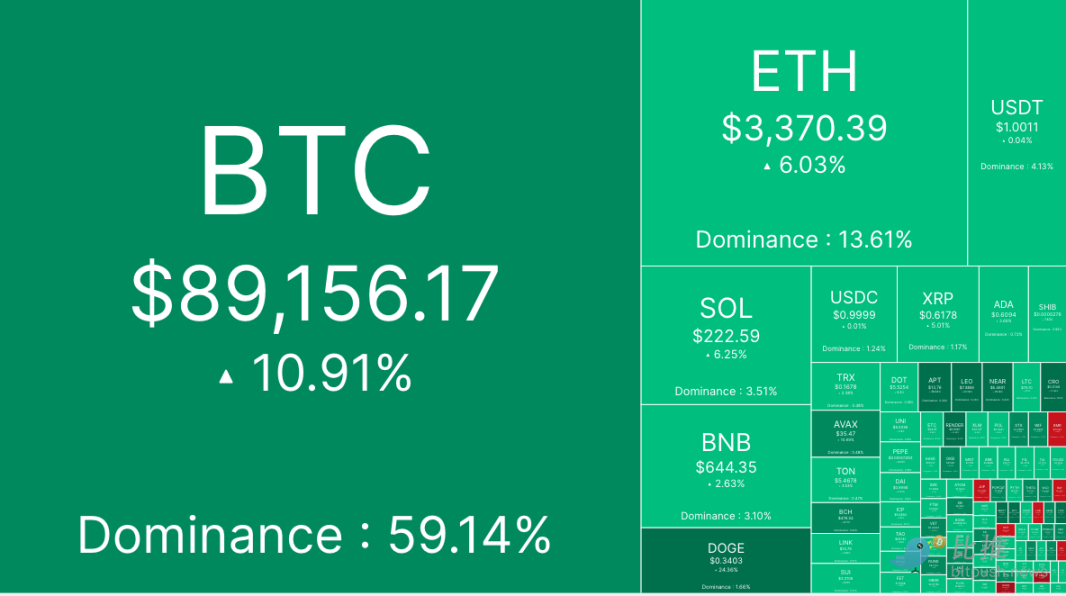

On Monday, Bitcoin was the clear winner, rising by more than 10% to $89,000, reaching a high of $89,575.96. Ethereum rose 6.4% to over $3,300, and Solana (SOL) rose 6.7% to over $220. Investor enthusiasm was unprecedentedly high, and Bitpush data showed that the total market value of cryptocurrencies exceeded $3.1 trillion for the first time since November 2021 (the peak of the last bull market).

In the U.S. stock market, cryptocurrency stocks surged that day, with Canaan Inc. (CAN.O) up 41% and MicroStrategy (MSTR.O) up 25%, closing at a record high of $340. The company announced on Monday that it had added 27,200 bitcoins, bringing its total holdings to 279,420, worth about $24.5 billion at current prices. Coinbase (COIN.O) rose 19%, and Robinhood (HOOD) shares rose more than 7%, a gain of more than 35% in five days. Earlier, Bloomberg reported that Dan Gallagher, Robinhood's legal director, was one of the candidates considered by the Trump team to lead the U.S. SEC.

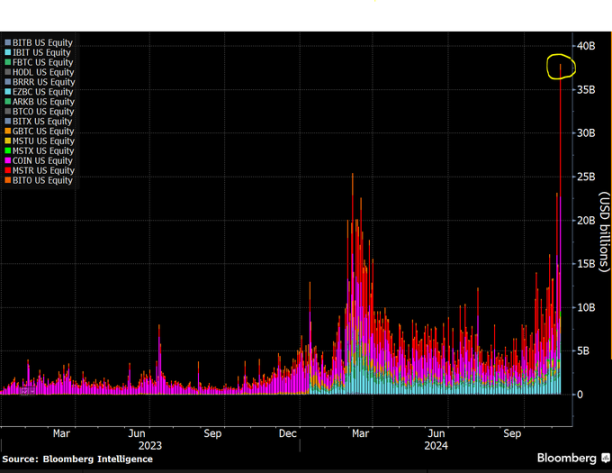

ETF trading volume continues to hit new highs

Since the election, inflows into spot cryptocurrency ETFs have continued to rise.

As Bitcoin soared above $88,000 for the first time, BlackRock's spot Bitcoin ETF also set a new daily trading volume record. Bloomberg data showed that BlackRock's spot Bitcoin ETF had a daily trading volume of $4.5 billion.

Citi strategists highlighted in a research note that cryptocurrencies are one of “the few Trump trades that have yet to pull back.”

The strategists said: "Part of the reason is that the Trump administration is expected to be friendly to cryptocurrencies, and investors hope that this will translate into regulatory clarity in the United States. Specifically, BTC and ETH ETFs saw net inflows of $2.01 billion and $132 million, respectively, in the two days after the election. We continue to view ETF inflows as the main driver of Bitcoin's gains."

Trump is looking for a crypto-friendly team, and the regulatory storm may subside

John Reed Stark, former head of the SEC's Office of Internet Enforcement, recently revealed that with Trump's victory in the US presidential election, the SEC's strict regulation of cryptocurrencies may see a turnaround.

Stark predicted in Twitter Space: "In the next few years, the SEC is unlikely to launch large-scale fraud lawsuits against the cryptocurrency industry." This statement undoubtedly injected a shot in the arm to the crypto industry, which has been plagued by regulation.

Stark believes that with Trump’s election, over-regulation of cryptocurrencies will become a thing of the past and the new SEC chairman will be more friendly. He also predicts that Gensler may voluntarily resign before Trump takes office to avoid the embarrassment of being fired.

Coinbase CEO Brian Armstrong also believes this will be "the most pro-crypto Congress ever."

In general, as the Republicans are about to take control of the House of Representatives after controlling the Senate, the crypto industry will usher in a more friendly regulatory environment. However, the specific policy direction still needs to wait for the new SEC chairman to take office before it can be finalized.

“The market may seem frothy to some, but please understand that we simply went from an objectively oppressive regulatory regime to an overly friendly one overnight,” Sean Farrell, head of digital asset strategy at Fundstrat, said in a X post on Monday. “The charts make perfect sense for BTC’s step-down returns.”

Bitcoin price could reach $125,000 by year end

Legendary trader Peter Brandt says Bitcoin could hit $125,000 by New Year’s Eve.

Brandt pointed out on the X platform that Bitcoin tends to repeat its strong market performance pattern when its price rises. He analyzed the current trend of Bitcoin breaking through its historical high point and predicted that its price could reach $125,000 based on Bayesian probability theory.

In simple terms, Bayesian probability (also known as Bayes' theorem) is a method of calculating the probability of future events using existing data. For traders, it can help them set price targets and deal with uncertain price fluctuations by comparing asset performance in similar situations in the past.

Brandt analyzed Bitcoin's price trend in the first quarter of 2024 based on Bayes' theorem and believed that it might replicate this pattern in the fourth quarter of 2024 and reach a high of $125,000 before New Year's Eve 2024.

Another trader, Titan of Crypto, predicts that the target price of Bitcoin's bullish triangle is $158,000. He believes that the emergence of a golden cross on the Bitcoin weekly chart is a key factor in the continuation of the bullish trend, and points out that $100,000 is the first target price of the second bull market in 2024.

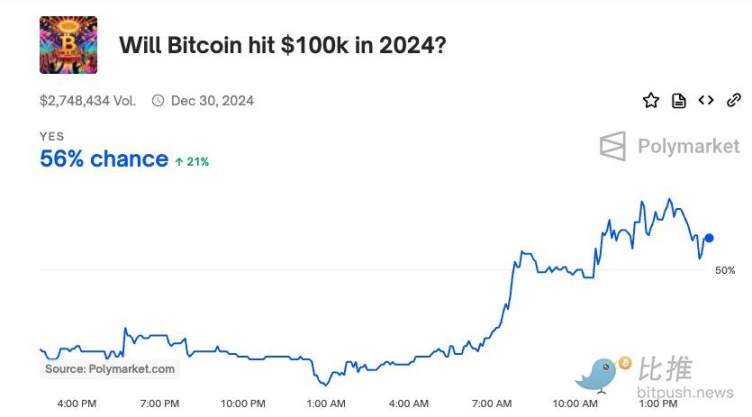

As of press time, on the Polymarket market that successfully predicted Trump's victory, users' bets on the probability of "Bitcoin breaking through $100,000 by the end of the year" have risen to 56%. At a price of $89,000, BTC is currently only 11% away from its target of $100,000.