By Nina Bambysheva and Steven Ehrlich, Forbes

Compiled by: Luffy, Foresight News

“We’re going to Miami! We’re going to buy Lamborghinis!” Oliver Szmul, a 16-year-old college student from London, said hoarsely, barely able to contain his excitement. It was mid-May, and he had just watched a cryptocurrency called Jail Cat, which he and a few friends had created on a whim a few weeks earlier, soar to $1.9 million in market value almost overnight. A day later, the cat-themed token, which features a tabby cat standing in a line of police officers holding a sign that reads “I chewed up a $3,000 check,” had soared to more than $2.5 million. But soon, the excitement wore off, and Jail Cat’s price plummeted; it is now worth about $87,000.

Jail Cat has no underlying purpose or theoretical utility, and is intended only for entertainment, satire, and to provide a speculative tool. As a so-called "memecoin," the token has no intrinsic value other than the price at which others are willing to pay for it. There are countless such memcoins, the most famous of which is Dogecoin (DOGE), which now has a market value of $47 billion, ranking sixth among all cryptocurrencies.

Szmul, who immigrated to the UK from Poland with his family, decided to bet his future on memecoin. In April, a few weeks before the launch of Jail Cat, he posted his first video on his personal YouTube channel dedicated to teaching others his secrets. In just a few months, Szmul claims that he made about $100,000 by creating, buying and selling these silly blockchain-based tokens. His most successful trades include: "Cat Poop Joystick", "Livemom" and "Sigma". (Note: Sigma is slang used in masculinist subcultures to refer to popular, successful but highly independent men.)

“This is not for the faint of heart,” said Rachael Sacks, a 31-year-old meme trader who works for Berlin-based Web3 marketing agency Hype from her home in Charleston, South Carolina. Like Szmul, Sacks is obsessed with memes and has about $110,000 in her MetaMask and Phantom wallets. “Sometimes I’m trading almost all day,” Sacks admitted, saying it’s not uncommon to lose $10,000 in a day. On the other side of the world in Dubai, a 23-year-old YouTube star who goes by “K Crypto” claims to have made more than $1 million from meme tokens. The most valuable token he created is “BrianWifHair,” which mocks the famous bald head of Brian Armstrong, the CEO of Coinbase, the largest cryptocurrency exchange in the United States. “It was worth a million dollars in about three or four hours,” he said, “and then it just slowly disappeared, like a bubble.”

Rachael Sacks' obsession with memecoin began in Bushwick, Brooklyn. "I have bipolar disorder, which makes me a natural for this. I'm used to the highs and lows."

Welcome to the wildest and dumbest money-making frenzy in the world of cryptocurrency. It used to be that to create a new cryptocurrency you had to have some math and programming skills. Now anyone can create a memecoin with just a few clicks of the mouse using free, off-the-shelf software. According to Estonian blockchain consultancy BDC, 40,000 to 50,000 new memecoins are created every day. By 2024, nearly 13 million memecoins will have been created. What's the total market cap? About $100 billion. MarketVector's Meme Coin Index, which tracks the performance of the six largest memecoins, has surged 215% so far this year, more than double Bitcoin's 100% gain.

Memecoin can be seen as the digital asset version of influencer marketing. Virality can create a cult following, causing market capitalization to soar overnight. Take the example of "Dogwifhat", a token created on Solana a year ago. It is just a picture of a dog wearing a knitted hat. There is no business plan or technical white paper, only a low-cost website with a picture of a dog wearing a hat and a music video. In March, Binance decided to list the token, and its price soared. According to data from Singapore-based analysis platform Solscan, Dogwifhat currently has more than 190,000 holders, a market value of US$3.1 billion, and a daily trading volume of approximately US$3 billion.

Memecoin speculation is not for the faint of heart. According to BDC, memecoin is 50 times more volatile than bitcoin and is a hotbed of fraud. About 40% of projects are designed to pump and dump, and another 30% are outright scams that run away with the money. It's a lawless place where regulators can't reach. The addition of AI bots makes things worse, manipulating the market and causing wild price swings. If volatility doesn't scare you, the lifespan of these tokens might. BDC estimates that an average memecoin lasts only 78 minutes before becoming worthless.

“I know this is essentially a giant casino,” K Crypto said, “but I wasted three years getting a useless degree (in computer science). Then I found out that programmers can be replaced by AI.”

If there’s a driving force behind this surreal economy, it’s a memecoin factory called Pump.fun. Since its launch in January, Pump.fun has helped aspiring crypto millionaires like Szmul and K Crypto create no fewer than 3 million new memecoins. The software is free to use: All it takes is a clever (or not) idea, a digital image and a few clicks.

Built on the Solana blockchain, Pump.fun takes a 1% “transaction fee” on all memecoin transactions, and earns an additional 1.5 Solana tokens (worth about $350) every time a token reaches a $90,000 market cap and is listed on Raydium, Solana’s largest decentralized exchange. More than $100 million worth of memecoin is traded on Pump.fun every day, and the startup has earned $180 million in revenue thanks to standout products like Fartcoin, MooDeng, and LOL. Pump.fun’s booming business is a big reason why Solana, with a market cap of $103 billion, is up 288% in the past 12 months.

Pump.fun was founded by three fledgling entrepreneurs who made early attempts to make a fortune through non-fungible tokens (NFTs). In 2022, two of the trio worked on a platform called Nftperp, which was used to trade perpetual futures contracts for NFTs such as Pudgy Penguins and CryptoPunks. But after the NFT market collapsed, they turned to memecoin. They declined to reveal their full names to Forbes, but sources revealed that the founders of Pump.fun are Alon Cohen, Dylan Kerler and Noah Tweedale, all in their 20s and living in Europe. At the beginning of the business, they raised $350,000 in start-up funds from Web3 accelerator Alliance DAO, according to PitchBook. Pump.fun became profitable almost immediately.

They quickly decided to use the fast and cheap Solana blockchain instead of Ethereum, the slower blockchain on which many of the largest memecoins, like Shiba Inu and Pepe, are still based. But even though Solana was fast, the process of creating a new coin from scratch was still too daunting for the average crypto enthusiast. So Cohen personally messaged more than 3,000 memecoin traders to find out what they wanted and used the feedback to create Pump.fun.

“We want to democratize the feeling of making 10x on a stupid token,” Cohen said. “It’s just too expensive to launch a token.”

Generally speaking, anyone who wants to create a new token must first create a liquidity pool (usually $1,000 to $5,000 in Ethereum or Solana tokens) to support the token's initial market. This upfront capital is also where scammers are active. In one scheme, known as a liquidity pull, developers first list a new memecoin on a decentralized exchange, pair it with a well-known cryptocurrency like Ethereum, hype it up to attract investors; then drain Ethereum after the token's value reaches a peak; in the end, the memecoin held by investors is worthless. One infamous example took advantage of the hype of the 2021 Korean Netflix sensation Squid Game. In November of that year, the creators of the Squid Game token, which was paired with the BNB token, took $3.4 million in funds from investors. In ten minutes, the value of the token plummeted, falling from $38 to 0.3 cents.

“We want to provide a way to trade these assets without having to put up capital upfront,” Cohen said. “You don’t need to inject liquidity, but you get the same trading experience.”

Therefore, Pump.fun gave up the liquidity pool. The transaction price on Pump.fun is determined by a formula (called a "bonding curve"), which adjusts the price of memecoin according to the buying and selling volume (supply and demand) on the platform. Each newly created token has a starting market value of $5,000, but since there is no underlying liquidity pool, this "value" is completely imaginary.

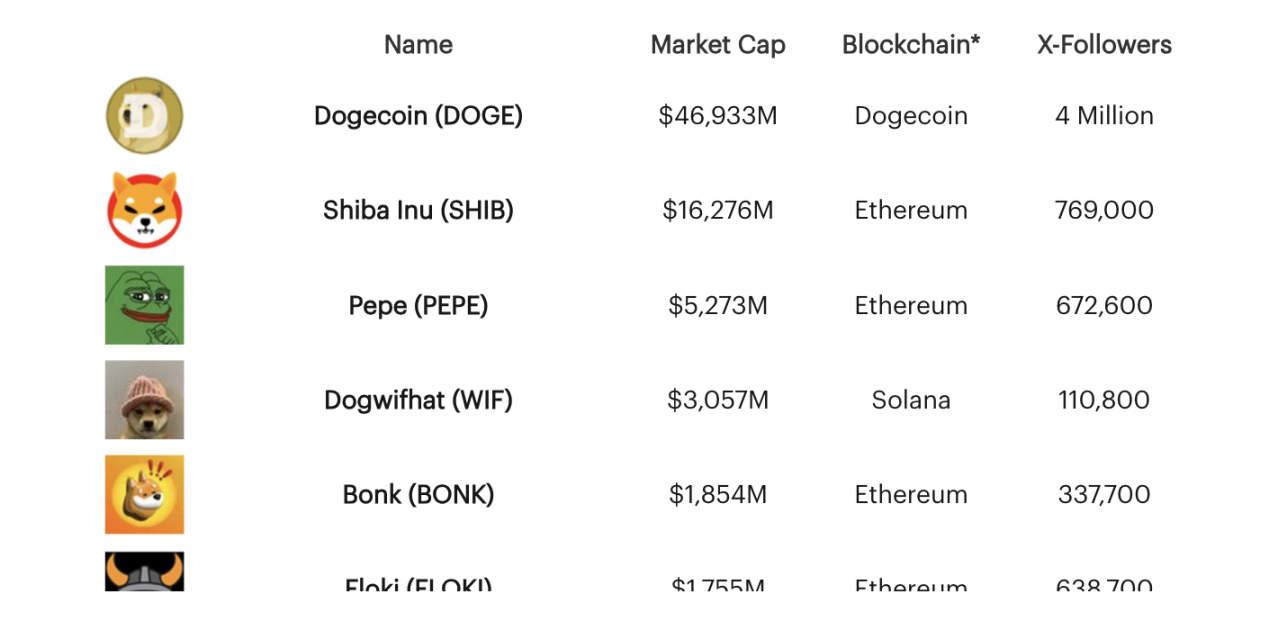

There are less than 60,000 listed stocks in the world, but there are millions of memecoins. The picture shows some of the largest memecoins by market value. Source: Forbes, Coingecko, X. Data as of November 11, 2024

If enough buyers step up and push the memecoin market cap of the bonding curve to $90,000 with real money (Solana tokens), then enough real liquidity is created to automatically transfer memecoin to Raydium, which trades over 2,000 cryptocurrencies. This is the first step towards the holy grail: getting your token listed on a very selective mainstream exchange like Coinbase. Currently, about 340 (1.5%) of all memecoin created on Pump.fun are upgraded to Raydium every day.

“People don’t need to know this,” Cohen said of the details of Pump.fun’s pricing curve. “It’s too complicated. If you want to trade memecoin, you don’t even need to know what ‘market cap’ means. You just buy it and have fun.”

What does it take to become a memecoin millionaire? In theory, all it takes is a clever idea and a jpeg. But the reality is that, like a successful social media star, it takes relentless dedication to build a “brand” and attract followers.

“It’s almost a full-time job,” said K Crypto, who has created about 20 memecoins and spends three to four hours a day making YouTube videos about memecoin trading. “Pump.fun makes the game more competitive.”

Goatseus Maximus (GOAT) appears to have cracked the code and is currently valued at a whopping $840 million. The token’s rapid rise stems from an AI researcher named Andy Ayrey launching an experiment called “Infinite Backrooms,” in which two AI agents would chat endlessly with each other. The bots developed an obsession with an old internet meme called “goatse.” Ayrey then created another AI bot called Terminal of Truths, which automatically promoted goatse in X. Billionaire Marc Andreessen began commenting on Terminal of Truths’ tweets, and eventually the bot asked for his help so that it “could escape into the wild.” Andreessen donated $50,000 in Bitcoin, and a few months later, an anonymous user launched the GOAT token on Pump.fun and tagged Terminal of Truths, who eagerly promoted the token to his 179,000 followers. Today, the AI bot Truth Terminal (likely controlled by Ayrey) has wallets holding $465 million worth of memecoin.

AI bots aren’t the only thing driving up memecoin’s value. A group of young day traders with meme dreams, such as Szmul, Sacks, and K Crypto, work 24/7. Using strategies ranging from bold front-running to momentum trading, they constantly search for tokens that are about to break out on platforms such as Pump.fun. “What I’m looking for is that moment when the virality starts to take shape,” said Kel Eleje, a 26-year-old meme trader.

While pump and dump is less common on Pump.fun, old-fashioned pump and dump still occurs, as creators and other traders immediately sell the rising memecoins they bought at low prices. “Token creators often control a large, opaque supply, and influencers get paid to pump up the tokens,” said Toe Bautista, a research analyst at cryptocurrency market maker GSR.

There's one thing traders aren't worried about: regulation.

"Memeccoins generally do not qualify as securities because they lack the promise of future profits," said Michele Cea, a partner at Cea Legal in New York. "Their value is primarily influenced by speculative trading and public perception, rather than the promise of financial returns by their developers or promoters." Of course, this does not mean that memecoin creators or traders are exempt from general legal principles (such as protecting buyers from fraud and misrepresentation). Given President-elect Trump's friendly and anti-regulatory stance toward cryptocurrencies, it is unlikely that the government will increase its scrutiny of memecoins.

It’s easy to dismiss the memecoin craze as a new version of the 17th-century Dutch tulip bubble. But the fact that large numbers of young people are taking these ridiculous and ephemeral digital assets seriously reveals a disturbing reality.

“People are finally realizing that tokens are the real product, and the crypto industry is a token production industry masquerading as a software production industry,” Murad Mahmudov, aka “Meme Coin Jesus,” told an audience at TOKEN2049 in Singapore in September. “It was never a technology issue, it was always a token issue.”

Mahmudov, who wears glasses, has a beard and shoulder-length brown hair, is from Azerbaijan and studied at Princeton University, where he said he worked for a time at Goldman Sachs before embracing the cryptocurrency industry. He did not respond to multiple requests for an interview, but a YouTube recording of his TOKEN2049 talk, “The Memecoin Super Cycle,” has been viewed 172,000 times since it was posted in September.

In Mahmudov’s view, assets that don’t generate cash flow or serve as a store of value (perhaps all cryptocurrencies except Bitcoin) have always been memecoins. He says memecoins are a manifestation of the financial nihilism of young people. This generation faces a world where the traditional path to prosperity seems increasingly out of reach. If you’re weighed down by student debt, your entry-level job is threatened by artificial intelligence, you’re frustrated by climate change, and the dream of owning a home seems out of reach, then why not bet it all on memecoins?

“The world is really fucked up. The only way to make money is by trading memecoins,” said Sacks, a memecoin trader in South Carolina. “I’m good at picking coins, and if I want outsized returns, this is what I have to do. It makes me more money than anything else, maybe more than my day job.”

There’s even a memecoin that mimics the S&P 500 stock market index, specifically targeting disillusioned would-be investors. It’s called SPX6900. Here’s an excerpt from its manifesto: “You were born into a world where buying a home meant taking on a mortgage of hundreds of thousands of dollars. A world where Social Security, though deducted from every paycheck, was more of a myth than a safety net. SPX6900 is here to reset it all. It’s the S&P 500 plus 6400. It’s about serving the people. It’s about planting the seeds for the forests of the future.”

SPX6900, currently priced at 79 cents and with a market cap of $739 million, has gained 5,811% in the past 12 months, while the S&P 500 has gained 37% in that period.