If you are a blockchain enterprise or startup that is thinking of entering new markets, you wouldn’t want to miss out on Asia. Asia has risen to be a market and a force that cannot be neglected in many aspects in the blockchain and cryptocurrency filed.

This article reveals some important facts about the Asian markets that you may not know before but can be helpful to you in making the decisions of your business.

Asia is a hotbed for leading crypto exchanges in the world.

Crypto exchanges are often regarded as the bellwether of the cryptocurrency industry. In recent years, leading crypto exchanges have been actively developing their own ecosystems by building their own blockchain networks, running their own mining pools, or even launching their own exchange token and stable coins, to gain an edge on their competitors amid increasing competition.

These activities together with the increased number of players in the crypto exchange field have collectively translated into growth in the overall number of users and transaction volume in the respective local crypto markets.

According to statistics of CoinGecko, there are 132 crypto exchanges among the world total of 416 exchanges with registered offices in Asia, representing 32%. While 11 of the top 20 are from Asia, representing 55%.

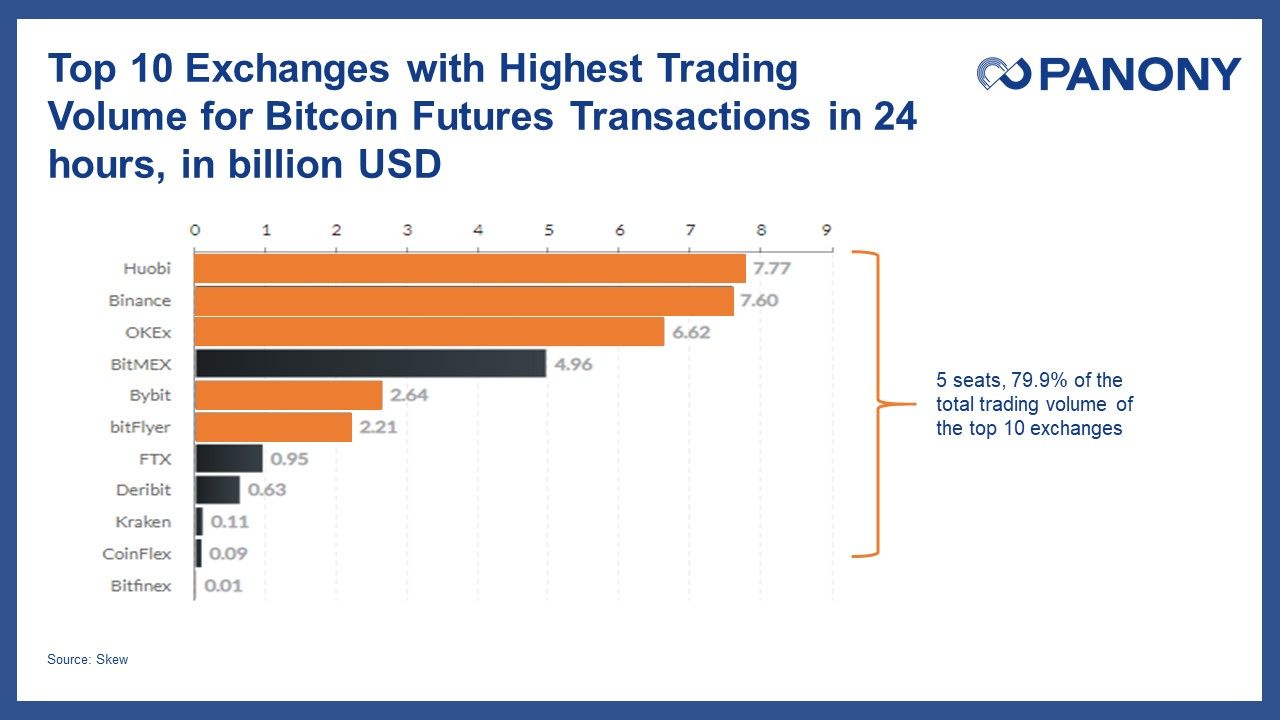

The number will be even higher if we include crypto exchanges with Asian executives but registered elsewhere, such as Huobi, Binance and OKEx, who claim the leading position in trading volume in general as well as bitcoin future transactions. Take the data on May 8 from Skew for example, exchanges with Asia background occupied 5 seats of the 10 crypto exchanges with the highest daily trading volume for bitcoin futures. They collectively account for 79.9% of the overall trading volume on the top 10 crypto exchanges.

Currency-wise, if we look at Bitcoin and fiat currency transactions, Asia is also a region that shouldn’t be overlooked. Although USD is still the fiat currency that sees the highest trading volume against bitcoin, accounting for 75.17% of the overall trading volume between bitcoin and fiat currencies, the fiat currencies of Japan, South Korea, and Turkey are also among the top 5 fiat currencies trading against bitcoin. And don’t forget China. Since cryptocurrency trading is in a grey area in this country, transactions between its fiat currency and bitcoin all happened over the counter and are not counted in most statistics. But considering China’s huge bitcoin mining power and the need for miners to cash out bitcoin for the cost of electricity and operating mining rigs, that alone, would make the real trading volume against Chinese Yuan/RMB massive.

Speaking of mining, Asia is the undisputed leader in bitcoin mining, both in terms of the number of leading mining pools and the total share of mining activity.

According to public data, as of May 1st, Asia based mining pools control 86.15% of the bitcoin network’s collective hashrate. Among the top 10 mining pools, 9 are from Asia.

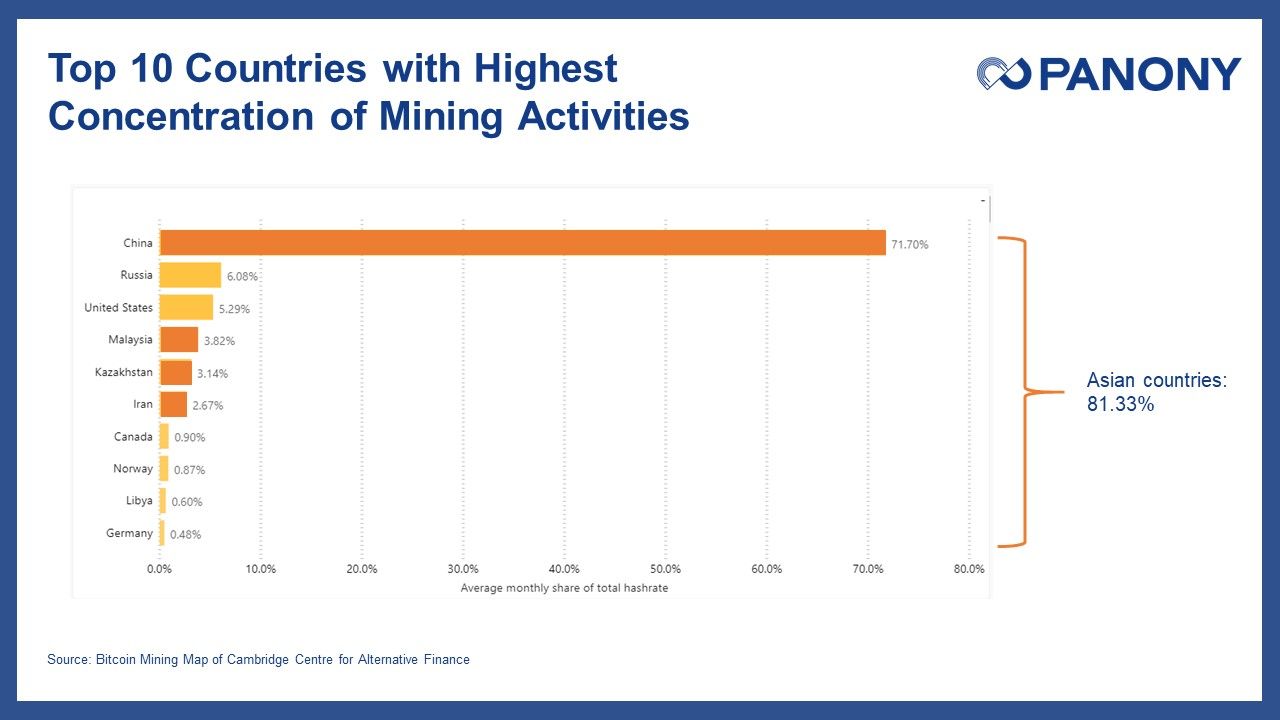

And a new tool for tracking global Bitcoin mining power released by Cambridge Centre for Alternative Finance in early May shows that, on a global scale, China makes up 71.70% of total global hashrate, followed by Russia and the U.S. And among the top 10 countries with the highest concentration of mining activities, 4 Asian countries, namely China, Kazakhstan, Malaysia, and Iran, have a total share of over 80% of the bitcoin network’s collective hashrate.

Factors such as cheap electricity, low labor cost, and a relatively favorable regulatory environment contributed to Asia’s rise as a world leader in crypto mining. But additionally, Asia is also home to some of the most well-known producers of crypto mining rigs. Bitmain, Canaan, Microbt, Ebang, Innosilicon. You name it. Those mining giants are all Chinese companies. This means China, and to a lesser extent other Asian countries would be the best place to deploy mining hardware for the close distance from the major producers.

Another interesting observation is that Asian countries are big into Decentralized Finance.

Out of the 20 top DeFi projects listed on DeFi Pulse, it looks like only a few projects are from Asia, such as InstaDApp, Nuo Network, and Kyber Network. However, if we analyze user traffic on these DeFi applications, we’ll see that Asian countries, especially China, are among the top countries for DeFi usage.

On MakerDAO, a major DeFi platform with 54% dominance in terms of value locked in its contracts, visitor volume from China is second only to the U.S. at 10.14% of the total user traffic.

Now, if we go micro a little bit and consider staking participation in blockchain networks, we’ll find Asia-based nodes taking the lead as well. This is especially apparent in networks that utilize Delegated Proof of Stake (DPoS) where many validators may be contending for a position.

Take EOS for instance. Of the top 21 supernodes, a startling 19 are based in Asia. These supernodes collectively have 5.9 billion votes or 50.31% of the overall voting power. Top Asian countries for EOS supernodes include China, Singapore, and Japan.

On top of all the above areas, what excites a lot of founders and entrepreneurs is that Asia has taken up 41% of global investment in blockchain, according to detailed research of blockchain investments conducted by PANONY’s research and published earlier on PANews.

Based on the research, there were in total 653 blockchain-related investments worldwide in 2019, in which the U.S. accounted for 181 investments and the greater China surpassed that with 191 deals. Collectively, 269 blockchain-related investments happened in Asian countries, making up 41% of the world total.

Meanwhile, governments of Asian countries are making more regulations to guide the development of the blockchain and crypto industry than the rest of the world.

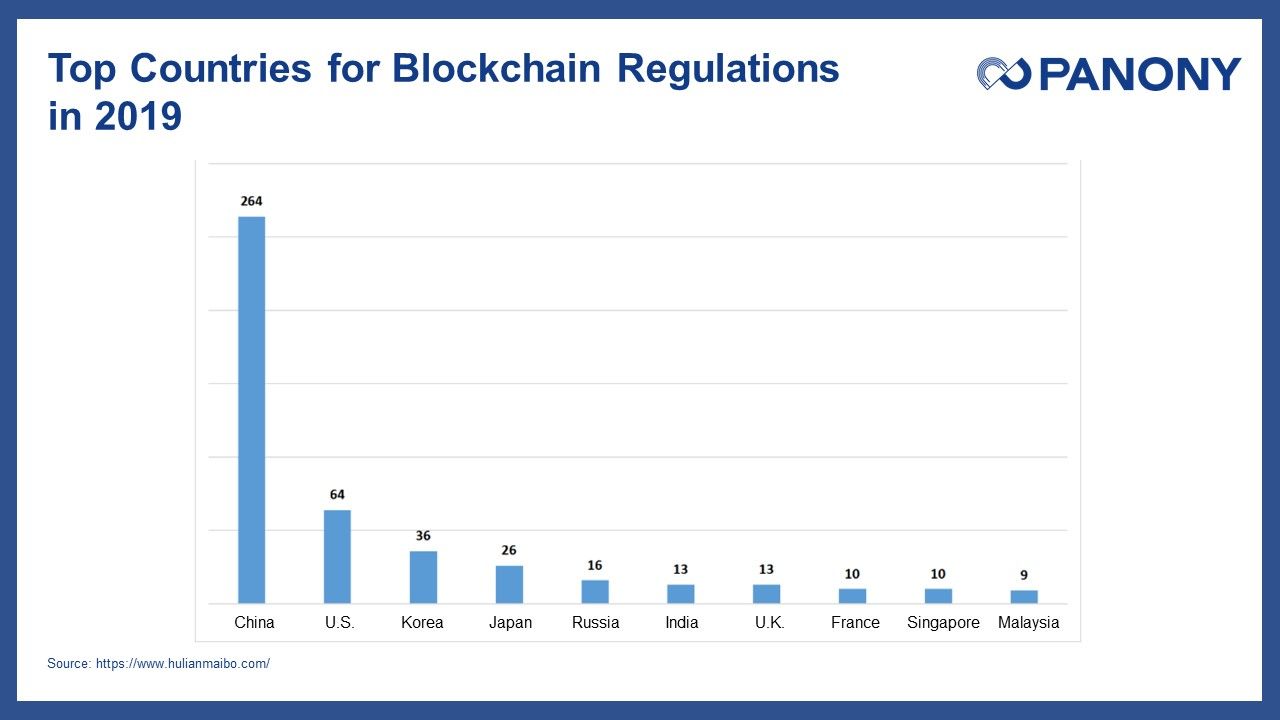

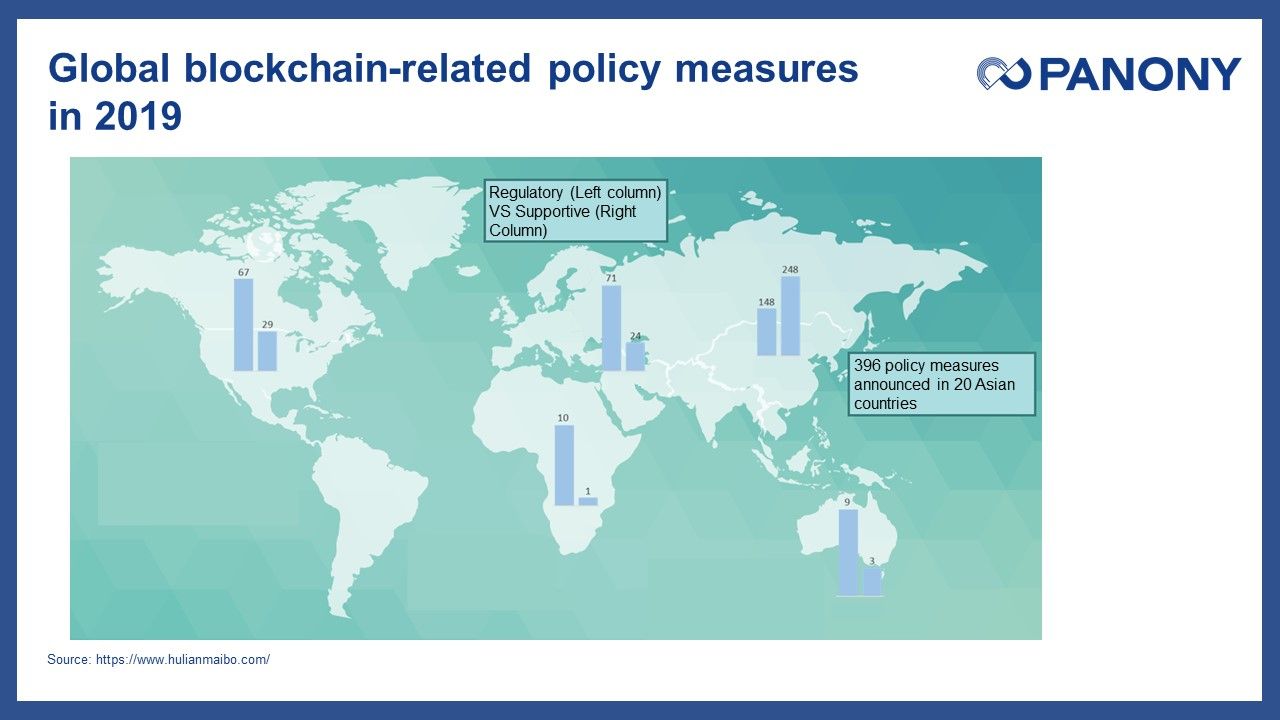

A research found that last year, there were 619 blockchain-related policy measures announced worldwide, of which 396 or 64% were announced in Asia, making Asia the most active continent in terms of blockchain regulation. Country-wise, China came first with 264 policy measures, followed up by U.S., Japan, and South Korea, with 64, 36 and 26 policy measures announced respectively.

Particularly noteworthy is that the policy measures in Asian countries consist largely of incentive measures like funding and resource support, while those in other continents mostly focus on the regulation side.

Having shared with you many aspects of the Asian markets, it goes without saying that China is becoming the biggest dark horse in the blockchain and crypto world.

Though China has banned ICOs in 2017, the country has never had an issue with the underlying technology. Instead, China’s government has made blockchain a national priority in several directions. Last year Chinese President Xi Jinping said in his first major comments on the blockchain that the country should implement the technology across the economy. The speech not only triggered a sharp rise of bitcoin price but also set off a blockchain fever among the public and waves of blockchain-driven innovation and investments at state and local levels.

Development of the technology is certainly underway in China. Since Feb 2019, 730 blockchain projects have registered themselves with Cyber Administration of China. And recent research of PANews on blockchain patents found that nearly 15,000 blockchain patent applications had been made so far in China. And two internet giants Tencent and Alibaba were at the top with 776 and 608 patent applications respectively since 2019.

Last month, an alliance of Chinese government groups, banks, and technology companies had publicly launched the Blockchain-based Service Network (BSN). The BSN is a global infrastructure to help blockchain projects create and run new blockchain applications for a lower cost. It also aims to accelerate the development of smart cities and the digital economy. It is among the first blockchain networks being built and maintained by a central government.

China is also leading the world in the development of national digital currencies. It has been working on the project for about six years, and just recently screenshots emerged of a digital yuan interface being piloted at one of four state-owned banks of China. China’s digital yuan or DCEP is designed to be a direct replacement of paper money and usable in areas without internet coverage.

Other Asian countries are actively developing their own national digital currencies as well. South Korea just launched a 22-month pilot program to review the technological and legal aspects of implementing its CBDC. Singapore has launched a digital cash-on-ledger project called Project Ubin in as early as November 2016 aimed at exploring the use of blockchain and distributed ledger technology for clearing and settlement of payments and securities. The multi-year-multi-phase project is now in its fifth phase and has since published 5 project reports.

To sum up, favorable government, regulatory, and investment environments have allowed Asian countries to excel in many aspects of the competition.

Amid the economic uncertainty and market turmoil brought by COVID-19, victims have emerged in the global blockchain industry. It is good timing to reflect, re-organize, and rethink the strategies that have been deployed.

Asian markets present a promising new playground for blockchain enterprises and startups that have yet to know its charms. These countries are one step ahead in putting the pandemic under control and in many countries, for example China, emerging technologies like blockchain are receiving a lot more interest and attention than before for their potential to help tackle similar pandemics and promote social and economic development.

Note: This content was presented at Crypto Asia Summit 2020, a video version is available here.