作者:Charlotte

随着BTC价格突破$89000,市场出现了久违的牛市氛围,山寨币出现了大幅上涨,其中多个公链代币出现了近一倍的涨幅。市场的回暖并未带来主流板块的出现,市场目前缺乏主流叙事,在未来一段时间内可能继续呈现这一态势。在没有主线叙事的情况下,以公链生态为切入点寻找Beta和Alpha可能是后续一段时间内可行的交易策略。因此,我们探索了一套分析框架,并在此框架下对近期表现突出的Sui和Aptos进行分析和对比。

1 分析框架:如何评估公链生态?

公链的爆发最直接的影响因素将是资金的大量涌入,大量的流动性进入将推动整个生态的发展,流动性溢出带来的造富效应将吸引更多市场关注度和资金进入生态,不断推高生态的活跃度。因此在评估公链生态时,我们将最关注可能造成资金大量流入的因素和公链承接流动性的能力,以及能够反映资金和用户流入的数据指标。

(1)本位交易的活跃度:无论是ICO和NFT时期的ETH,还是Memecoin时期的SOL,以及铭文时期的BTC(同时通过挖矿和购买促进对BTC的需求和消耗),都是进行交易的本位代币,当NFT、Meme等产生极强造富效应后,用户都需要购买本位代币才能进入新的Crypto Casino,创造了对公链代币极大的原生购买需求,从而推动价格上涨和生态繁荣。这些大型Casino既是生态的一部分,通过生态的繁荣直接推动了公链代币的增长,又吸引了大量的资金进入链上,流动性溢出将会造富其他生态项目,从而盘活整个生态。在这个维度上,公链和交易所其实存在着冲突,大量优质项目TGE直接进入交易所,而不会造福公链本身,想要形成公链代币的本币交易,必须要依靠只存在(或初期只存在)于链上的新资产,如NFT、铭文、Meme都是如此,我们会密切关注不同公链上新的具有造富效应的资产发行玩法,但目前还没有看到显著创新,因此更短期会关注哪条公链会在Meme赛道上承接更多来自Solana的流动性溢出。

(2)生态基础设施完善程度,以及是否具有吸引流动性的窗口和激励措施:基础设施的完善程度决定了资金在进入后是否有意愿留下,用户友好的体验和丰富的资金生息策略将会更有利于用户和资金的留存。吸引流动性进入的窗口和激励措施会更有利于促进资金的进入。主要的资金进入渠道有三个:其他公链、CEX和Web2,资金迁移的摩擦度逐级提高,能够吸引越多层级的资金进入,越有利于公链的发展。如Base背靠Coinbase,打通了从交易所直接进入链上的路径,发行的cbBTC和流动性引导激励也为生态吸引了更多TVL,Solana正在推行Payment和Payfi的发展,希望吸引Web2的资金进入链上。

(3)公链的发展战略、定位:包括公链对发展路径、主要市场、核心赛道的规划,例如,Solana团队在本轮中具有非常清晰的发展路径,核心团队从主推Meme赛道起家,通过Meme赛道吸引了大量的用户和流动性,随后大力推动Payfi、DePIN等赛道发挥高性能公链的优势,吸引了Render、Grass、IO.net等一众龙头项目的入驻,而以太坊在本轮缺少核心发展战略,Rollup-centric的路线图也饱受诟病。

(4)资金与用户数据变化:公链TVL往往被作为衡量生态资金体量的数据,但TVL本身主要由公链代币和生态代币组成,受到币价影响很大,不能准确反映出资金的流入,此外,Defillama等平台在计算公链TVL时将各DeFi协议的TVL直接相加,处于流通中的代币并没有被算为TVL,而代币处于流通状态本身可能说明有更强烈的交易需求。因此,本文将重点关注稳定币市值的增长、生态资金的净流入情况和DEX交易量等,作为资金和流动性变化的指标,同时关注用户活跃度。

(5)公链代币的筹码结构和价格走势:公链生态的成长性和币价一般是相辅相成的,公链币价的上涨会吸引更多市场关注度,在公链代币大幅上涨后,市场会寻找生态内的项目投资期望获得更高收益,这种流动性外溢会促进生态的繁荣和整个生态造富效应的增强。代币经济学和筹码结构将会决定公链代币的上涨阻力和时间窗口,上涨阻力更小、空间更大的代币将更有可能带动整个生态的繁荣。

2 Sui生态解析

2.1 公链基本信息与近期进展

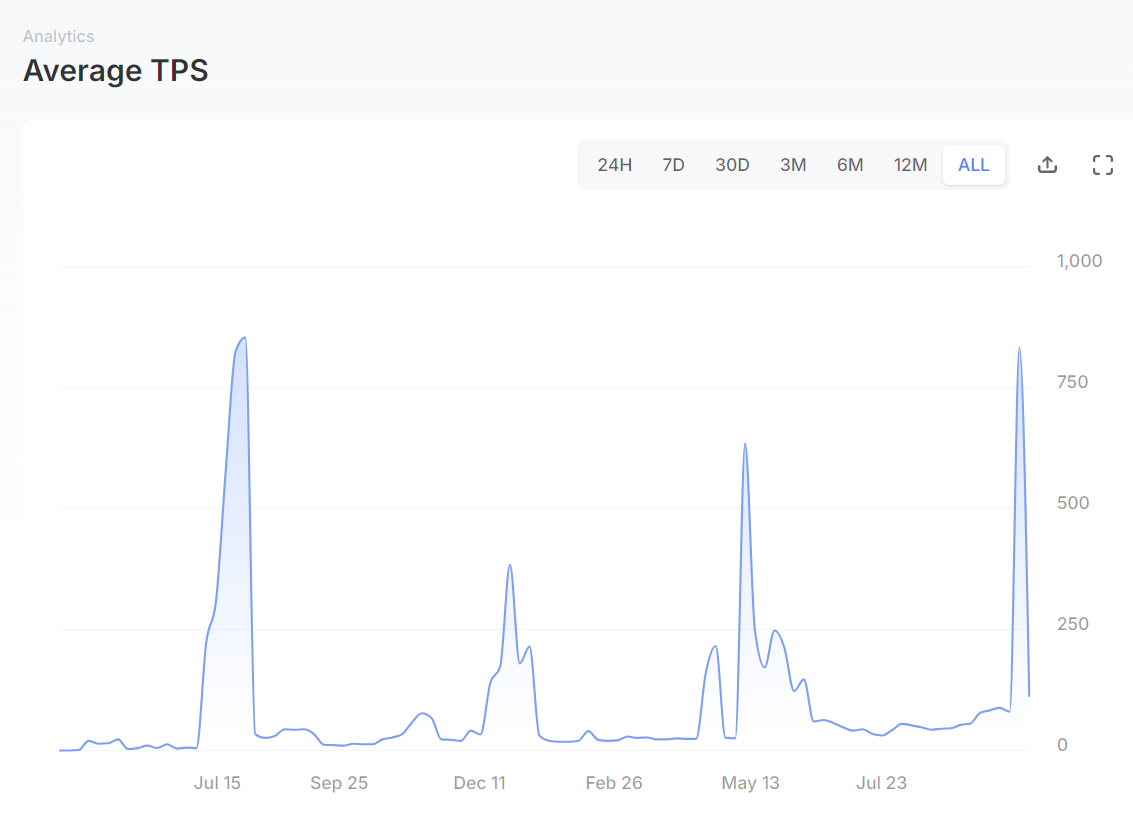

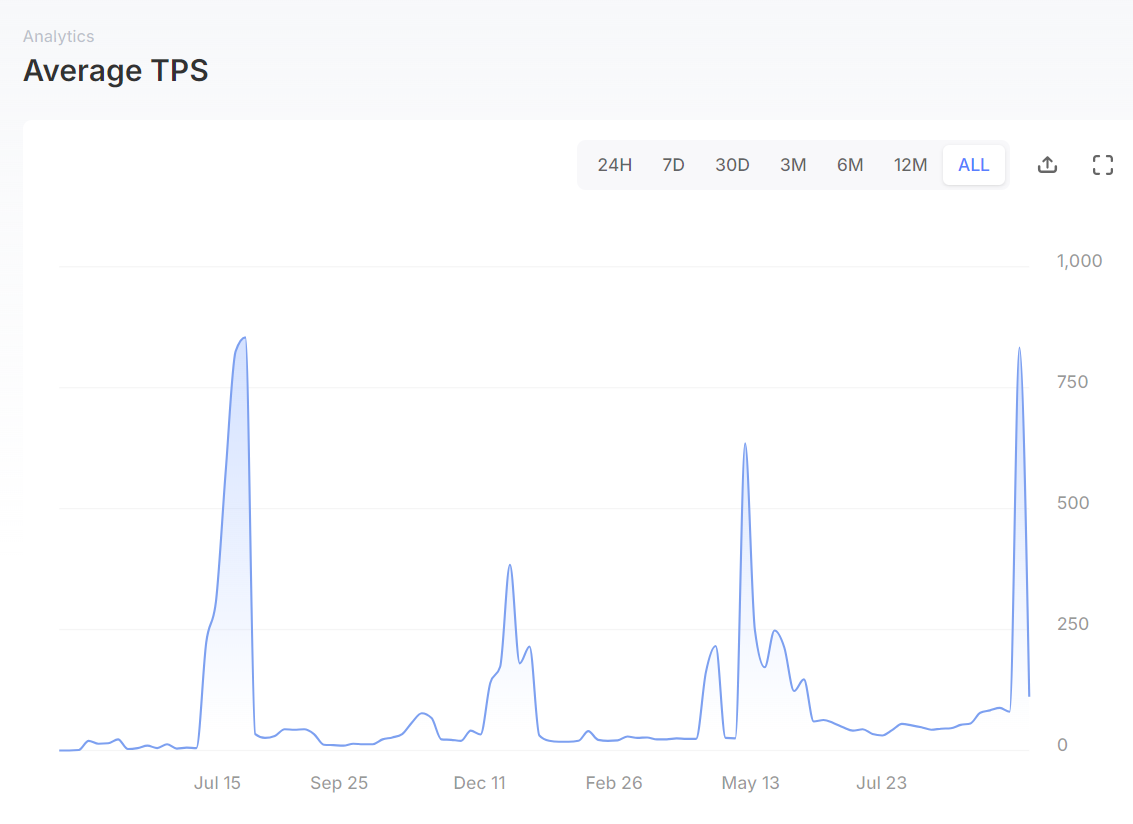

Sui是基于Move语言的高性能Layer 1公链,由Mysten Labs开发。在性能上,根据Sui Foundation所公布的数据,Sui的最高TPS可以达到297,000,在实际运行中,Sui目前最高的TPS达到800左右。

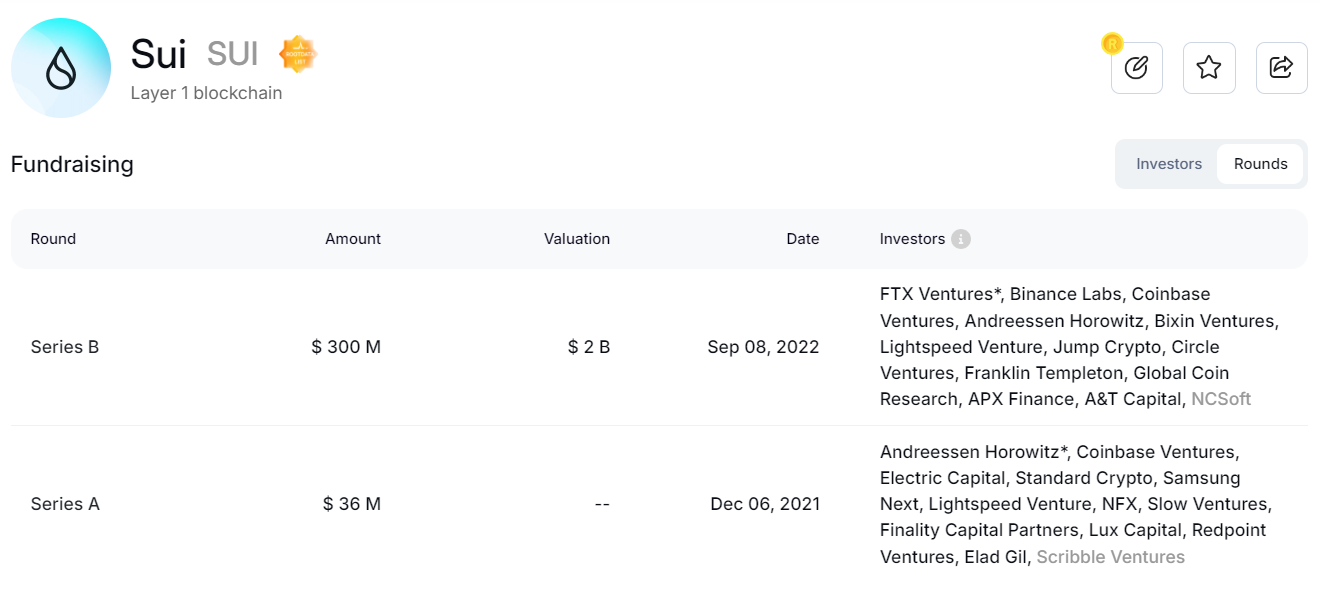

在融资背景上,Sui公布了A轮和B轮的融资,共完成$336M的融资,B轮融资估值为$2B。投资方背景强大,包括A16z、Coinbase Ventures、Binance Labs等头部基金参与投资。

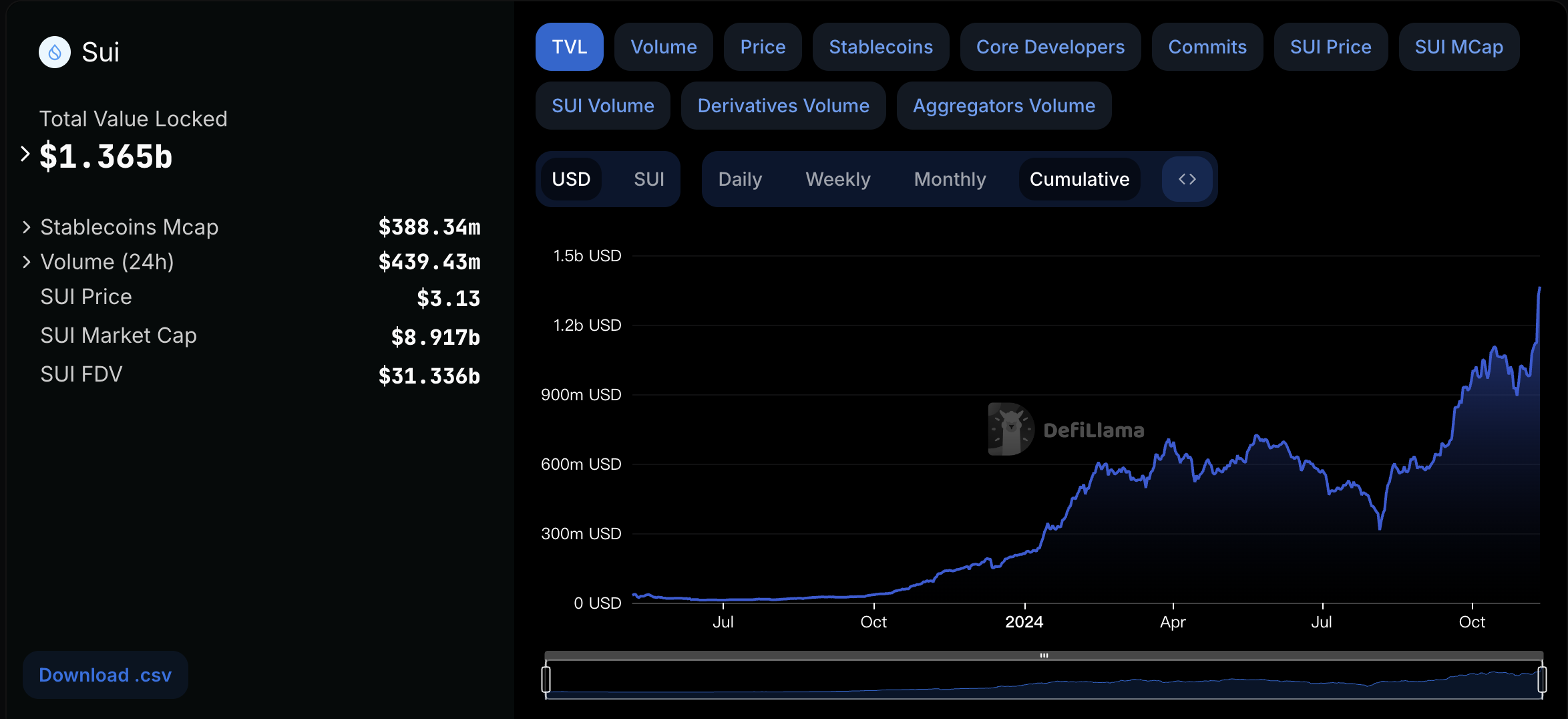

Sui主网上线于2023年5月3日,在过去的一年半中,Sui生态TVL快速攀升,目前在所有公链生态中位居第5位,并形成了包括DEX、借贷、稳定币、流动性质押等DeFi基础设施生态。Sui生态早期在发展初期并未收获太多稳定的日活用户,直至2024年5月开始吸引大量用户,目前日活用户量稳定在1M左右。

SUI的币价从9月进入快速拉升阶段,成为9月表现最好的加密资产之一,大幅跑赢BTC和SOL,近期价格高点已经接近前高。伴随着币价的攀升,Sui近期公布了多个生态进展:

- 2024年9月2日,Sui宣布推出掌上游戏机SuiPlay0X1,原生支持Sui生态游戏和Steam、Epic游戏库,游戏机售价为$599,将于2025年交付。

- 2024年9月12日,灰度宣布推出Grayscale SUI信托基金,正式向合格投资者开放。截止10月8日,该基金的AUM已超过$2.7M。

- 2024年9月17日,Sui与Circle达成合作,USDC拓展至Sui网络,10月8日,原生USDC已经在Sui主网上线。

- 2024年10月1日,Sui Bridge在主网上线,目前支持Sui和以太坊之间的ETH和WETH桥接,由Sui网络验证器保护。

2.2 本位交易活跃度

Sui生态没有诞生太多新的资产玩法,但10月初的Memecoin交易相对活跃,HIPPO、BLUB、FUD、AAA、LOOPY等代币表现不俗,尤其是HIPPO带来了非常好的造富效应,目前已经是Sui生态除仅次于CETUS和DEEP的代币,该代币相比于低点来说以上涨超过50倍在高点下跌超过70%后,目前出现了较大的回升。Memecoin的交易热情也体现在新代币数量的快速增加,自9月份中旬以来,Sui上新创建代币的数量保持在每日300个以上,10月以来多日达到1000个以上,但目前已回落到较低水平。

在Meme交易基础设施上,Cetus作为主要的AMM,交易Bot一般使用PinkPunkBot,Movepump是类似于Pump.fun的Memecoin launchpad,在流动性达到阈值后代币将上线BlueMove Dex,这使得其TVL和交易量数据在十月初大幅上涨。

2.3 生态系统概览

根据Sui Directory统计,Sui生态上共有86个项目,其中除基础设施外,主要以游戏(23个)和DeFi(16个)为主。根据CoinGecko数据,Sui生态项目的市值较低,市值处于前500名的项目除SUI外只有最近涌现的HIPPO,市值处于前1000名的项目除稳定币外包括FUD、CETUS、BLUB和NAVX,即只有Meme和DeFi龙头项目,可投资的标的较少。

根据DeFillama统计,Sui生态的DeFi协议共有40个,其中排名前三的协议分别为:NAVI Protocol(借贷)、Cetus AMM(DEX)、Suilend(借贷),Scallop Lend(借贷)和Aftermath Finance(交易聚合与流动性质押)的TVL紧随其后,此外还拥有收益聚合协议AlphaFi、稳定币协议Bucket和衍生品交易协议Bluefin。

-

NAVI Protocol:Sui生态上的龙头借贷协议,TVL为$314.8M,提供借款总量为$464.63M,借出总额为$149.83M,TVL的组成以WUSDC和SUI及SUI的衍生品为主,其中,Sui链上的WUSDC总量为$283.05M,NAVI Protocol中WUSDC所占的TVL约为9亿美金,占比超过30%。NAVI Protocol正在建设Volo,是SUI的流动性质押协议。协议代币NAVX近期价格表现较好,相比8月5号暴跌后的低点($0.003)到目前价格($0.19)已上涨了6倍多,10月4日,NAVX上线Bybit并开启Launchpool。

-

Cetus AMM:同时建设在Sui和Aptos上的DEX,也是Sui生态上最成熟的DEX,在交易策略上支持AMM Swap、限价单和DCA的交易形式,在AMM中使用集中流动性(CLMM)策略。此外,Cetus集成了 Wormhole SDK,在自身前端建立跨链桥接口以丰富用户体验。CETUS币价同样表现优异,自8月5日低点($0.038)上涨接近$0.02,涨幅超过5倍,随着近期上线Binance,CETUS的价格再次上涨超过1倍,目前市值约为2.6亿美金。9月23日,Cetus开启第一季Meme Season,旨在对Cetus上交易的Meme代币提供grants。自10月以来,Cetus的交易量大幅上升,每日交易量超过1亿美金,已突破今年3-4月份的峰值。

-

Suilend:Sui生态上借贷协议龙二,提供借款的总量为$227.58M,借出总额为$57.69M,在贷款总额和利用率上均低于NAVI Protocol。TVL的构成同样以SUI和WUSDC为主,SUI和WUSDC构成的TVL总额与NAVI Protocol相当,但暂时未引入SUI的衍生品。该项目由Solend项目方构建,因此可以将SOL包装到Sui生态进行生息。值得一提的是,Suilend和NAVI Protocol都以SUI或SUI的衍生品对借贷行为提供激励,Suilend使用SUI,NAVI Protocol使用vSUI。2024年5月,Suilend发起积分活动,奖励向平台存入资产的用户。

2.4 生态发展战略

Web3 Gaming一直是Sui生态战略中非常重要的一环,Sui所采用的Move系语言采用面向对象的架构,将对象作为数据存储的基本单元,而不是像其他区块链一样使用账户模型,这使得在Sui上能够定义更丰富和可组合的链上游戏资产,同时Sui的可扩展性、zkLogin等也为游戏用户提供了更接近Web2的游戏体验。

在Sui生态发展早期,生态旗舰游戏Abyss World吸引了大量市场关注,该游戏得到了AMD和Epic Games的支持,2023年6月24日,日本社交游戏巨头宣布成为Sui的验证者节点,并在Sui上进行游戏开发,2023年9月22日,韩国游戏开发商NHN被报道正在基于Sui开发链游,2023年9月28日,Sui推出Web3游戏门户Play Beyond,便于用户一站式探索Sui上的游戏。但由于链游赛道在本轮周期的表现不佳,Sui上也并未跑出有出圈效应的游戏。从数据上看,尽管游戏和Social项目在2023年是Sui用户的主要来源,但在进入2024年后,Sui生态陷入沉寂。

近期,Sui生态在多方面开始共同发力,在战略上似乎与Solana早期十分相似:SUI代币价格快速上涨、出现有造富效应的Meme、生态代币全面起飞,此外辅之以灰度建立Sui信托基金、原生USDC登陆Sui生态、生态项目代币上线核心CEX、Sui Foundation宣布对生态项目的投资等一系列利好消息,快速吸引市场对Sui的关注,并不断有“Solana Killer”的声音出现。同时可以看到,Sui生态依然将游戏作为生态主线之一,包括SuiPlay0X1的推出,以及灰度对Sui游戏的宣传短片等。

此外,在市场选择上,韩国市场对Sui表现出高度的兴趣,SUI代币持续占据Upbit交易所的交易量前几位,在SUI代币的现货交易量中,Upbit仅次于币安,可见韩国市场在Sui生态的重要程度。

2.5 资金与用户数据变化

在资金数据上,Sui生态的TVL自8月5日以来快速增长,从低点的3亿美金左右上涨到超过10亿美金,但由于TVL主要由SUI和生态代币构成,这一数据并不能反映Sui生态的真实资金流入。

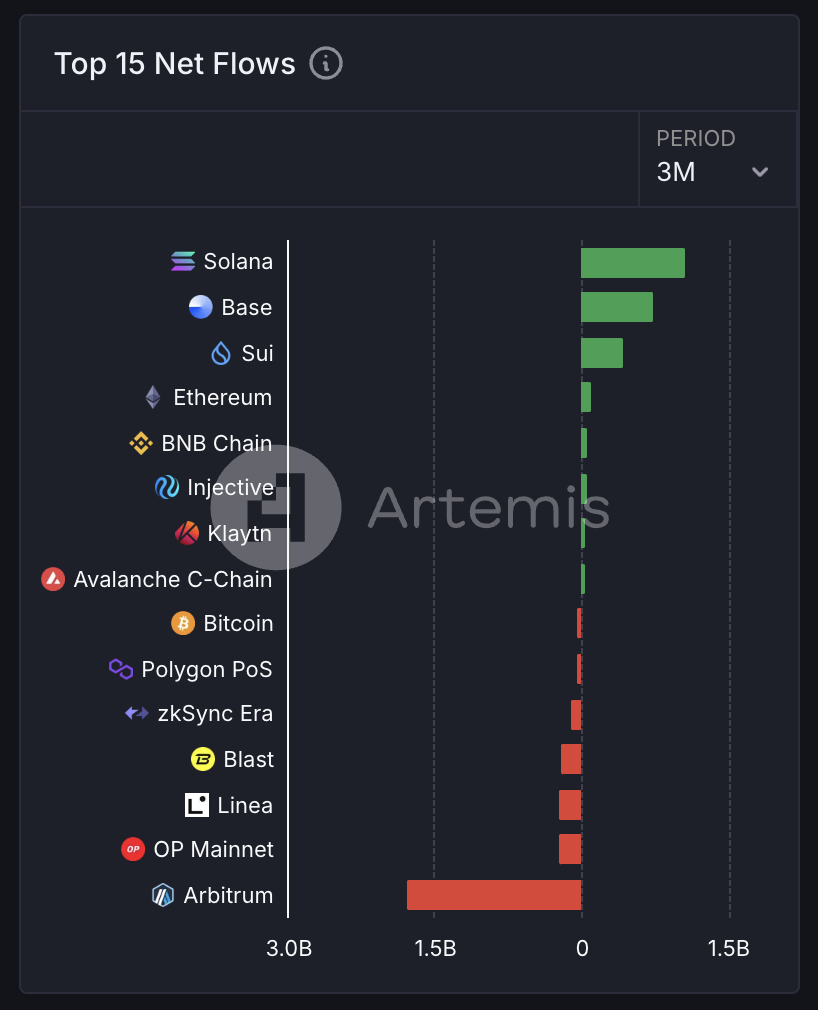

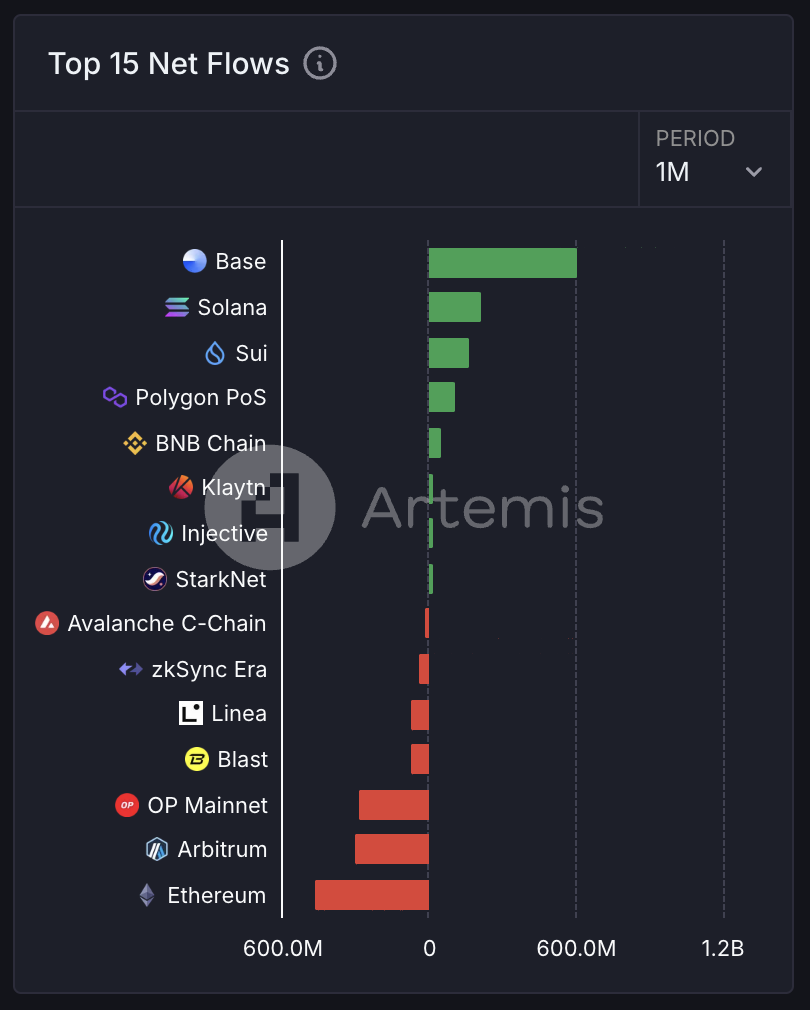

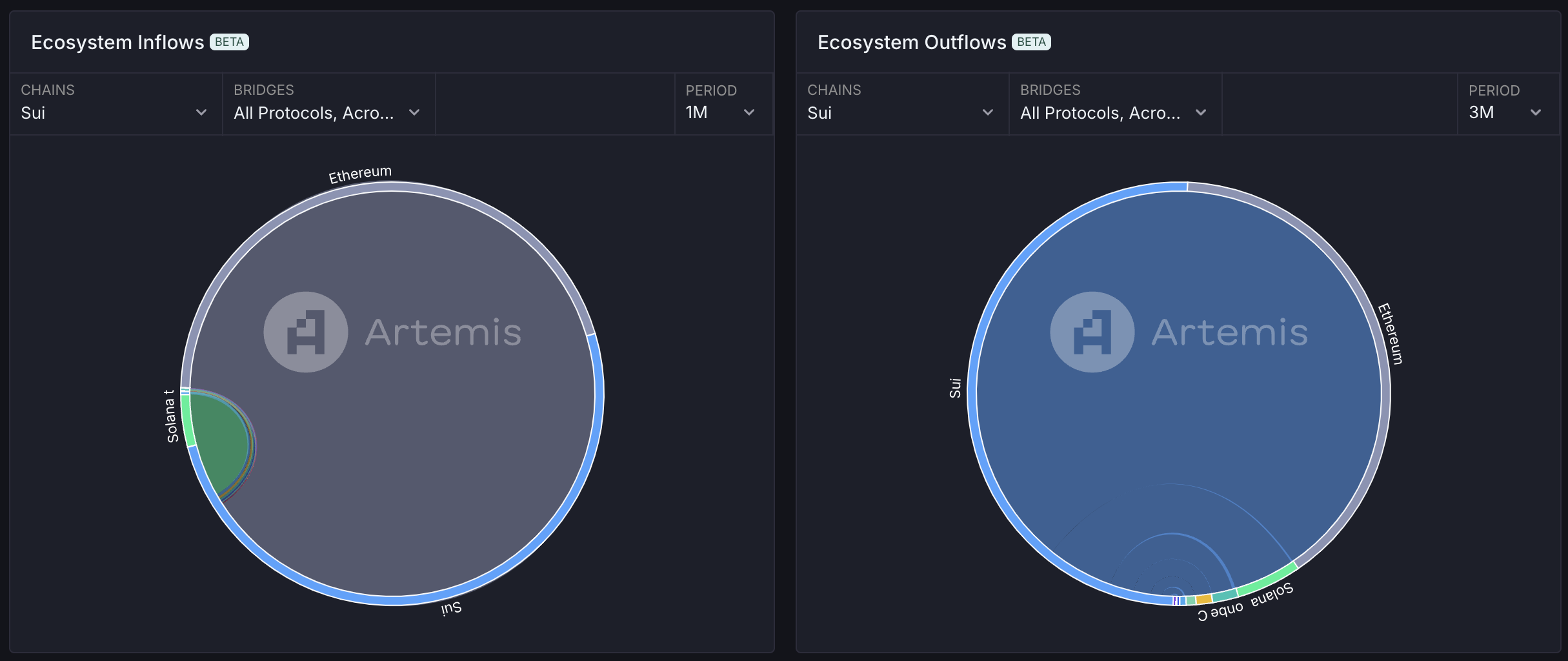

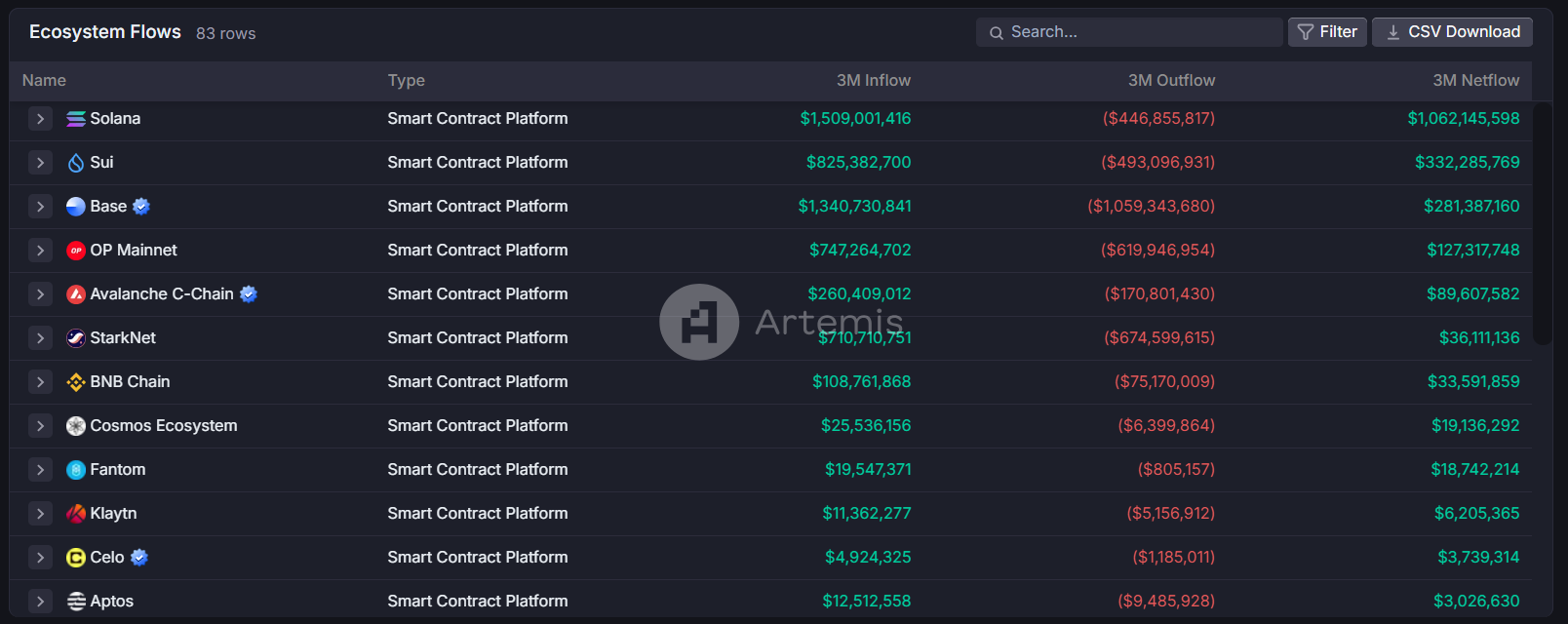

更准确的指标可能是稳定币市值和资金流入。目前Sui生态稳定币市值约$380m,8月6日后其稳定币市值增长到437M,此后快速下降。从资金流入看,Sui近一个月和近三个月的资金净流入量均处于正值,并位居所有公链生态第三,资金流入情况良好。从流入和流出资金的来源上,Sui的主要流入和流出生态均是以太坊。

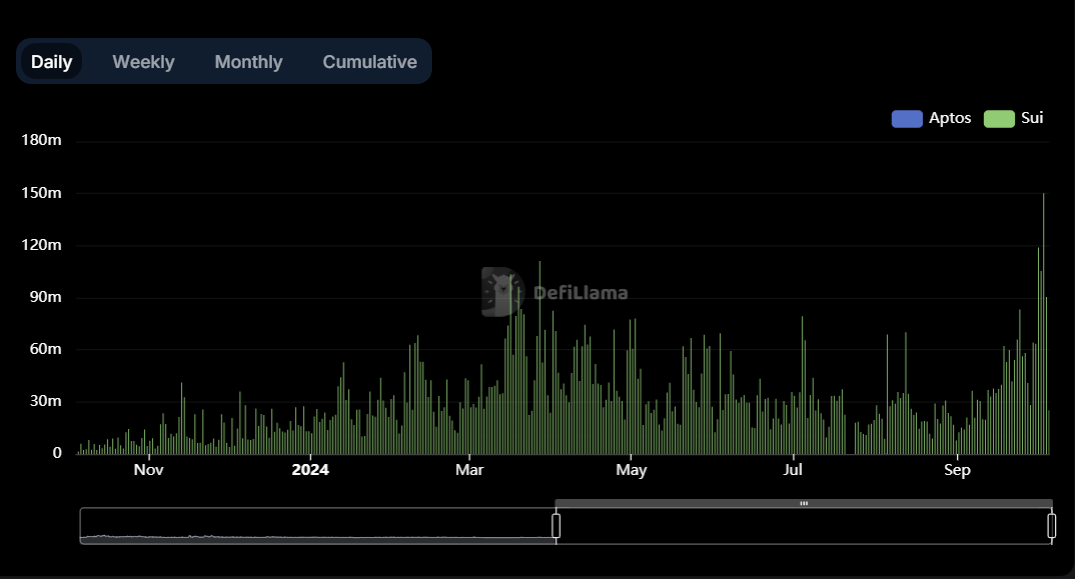

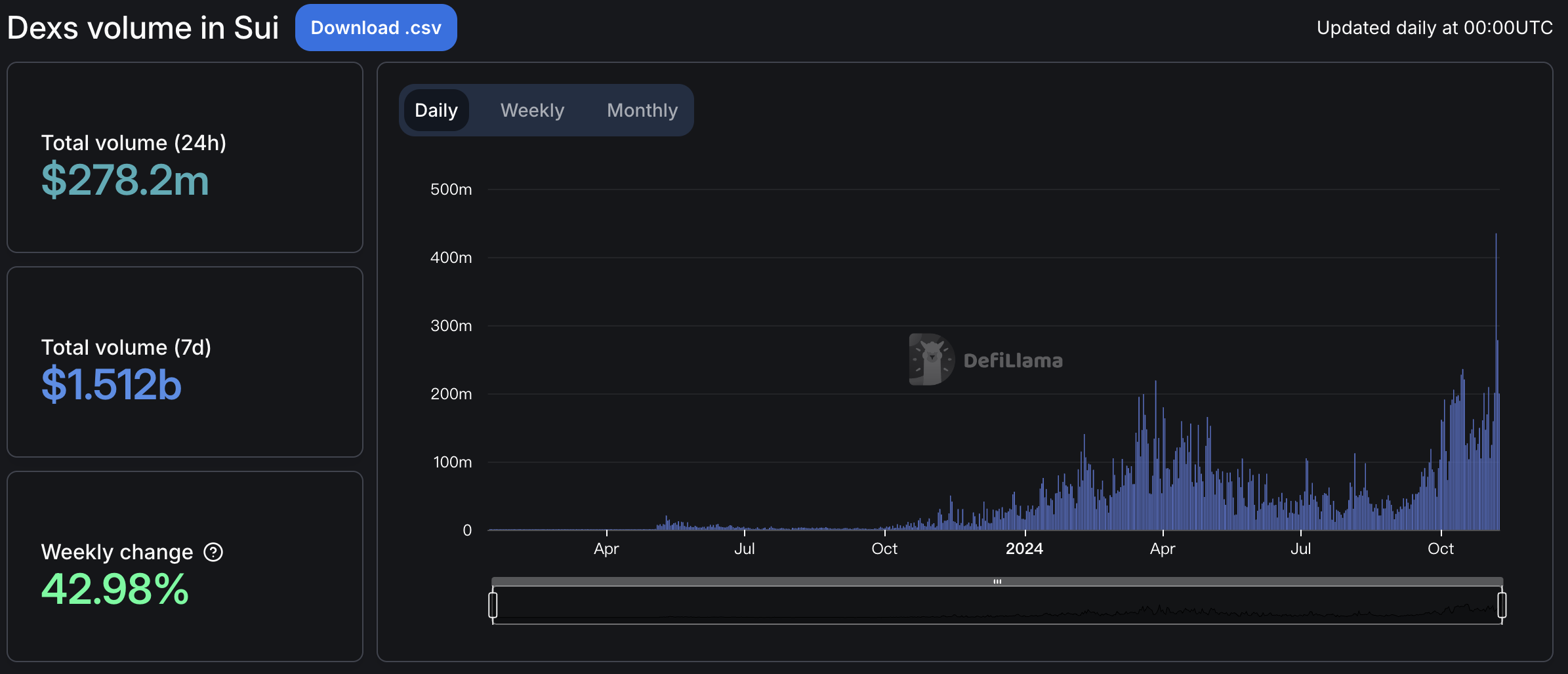

此外,在交易活跃度上,Sui的DEX Volume在所有公链生态中位居第6位,从9月以来交易量正在显著恢复,目前已超过3-4月的峰值水平,每日交易量超过200M。其中Cetus贡献了超过85%的交易量,主要的交易对为SUI-USDC、SUI-wUSDC、HIPPO-SUI、CETUS-SUI。

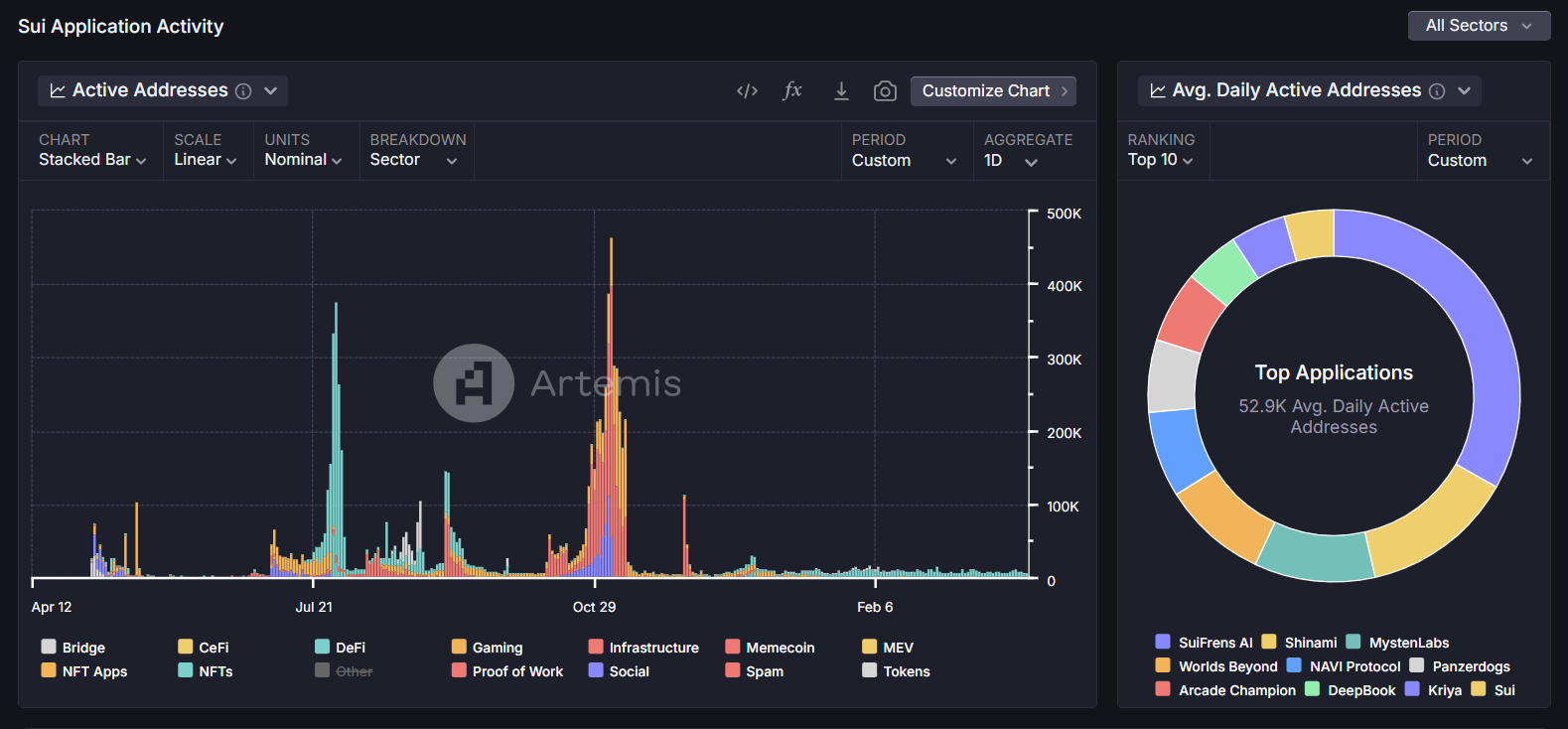

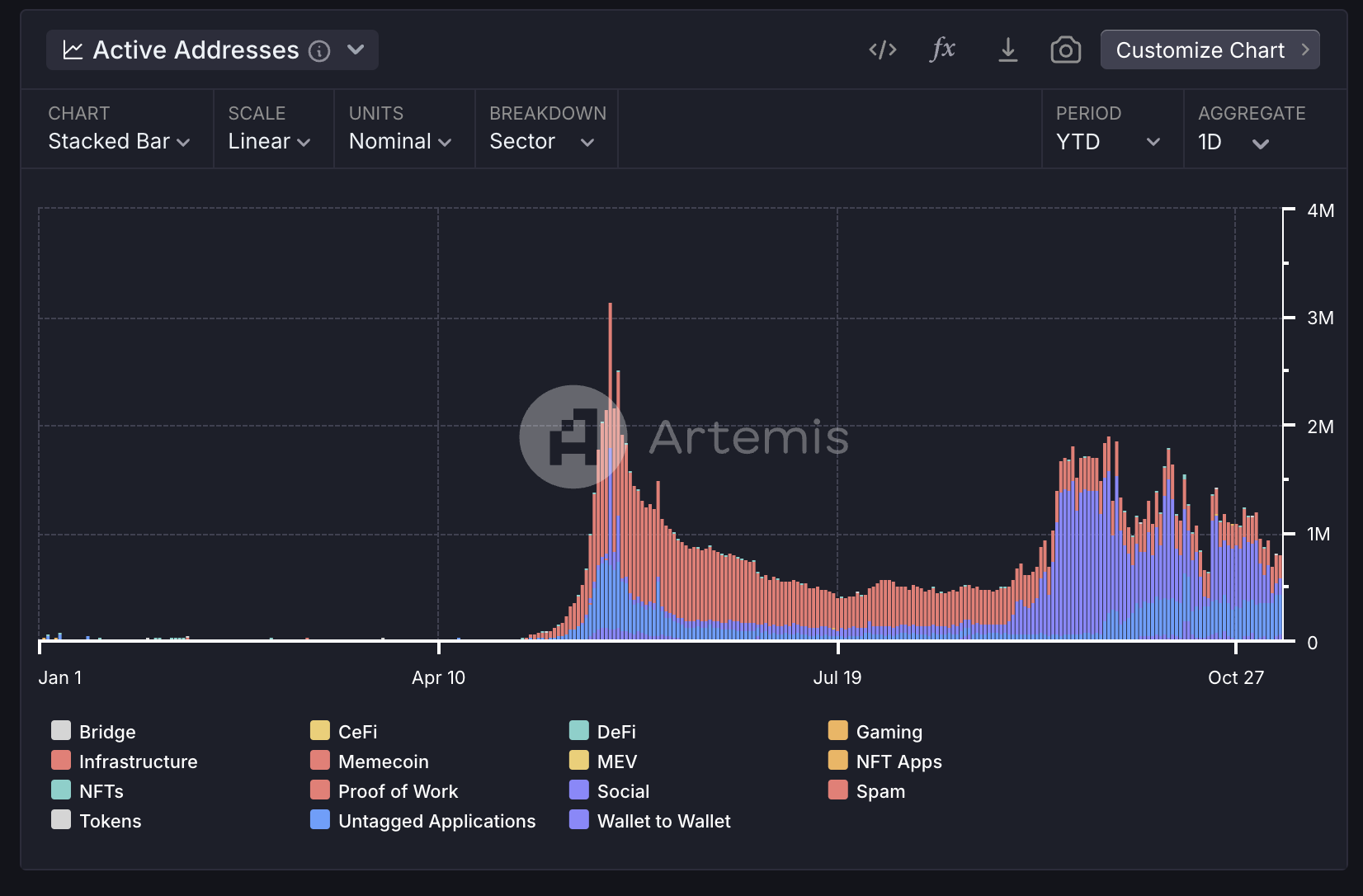

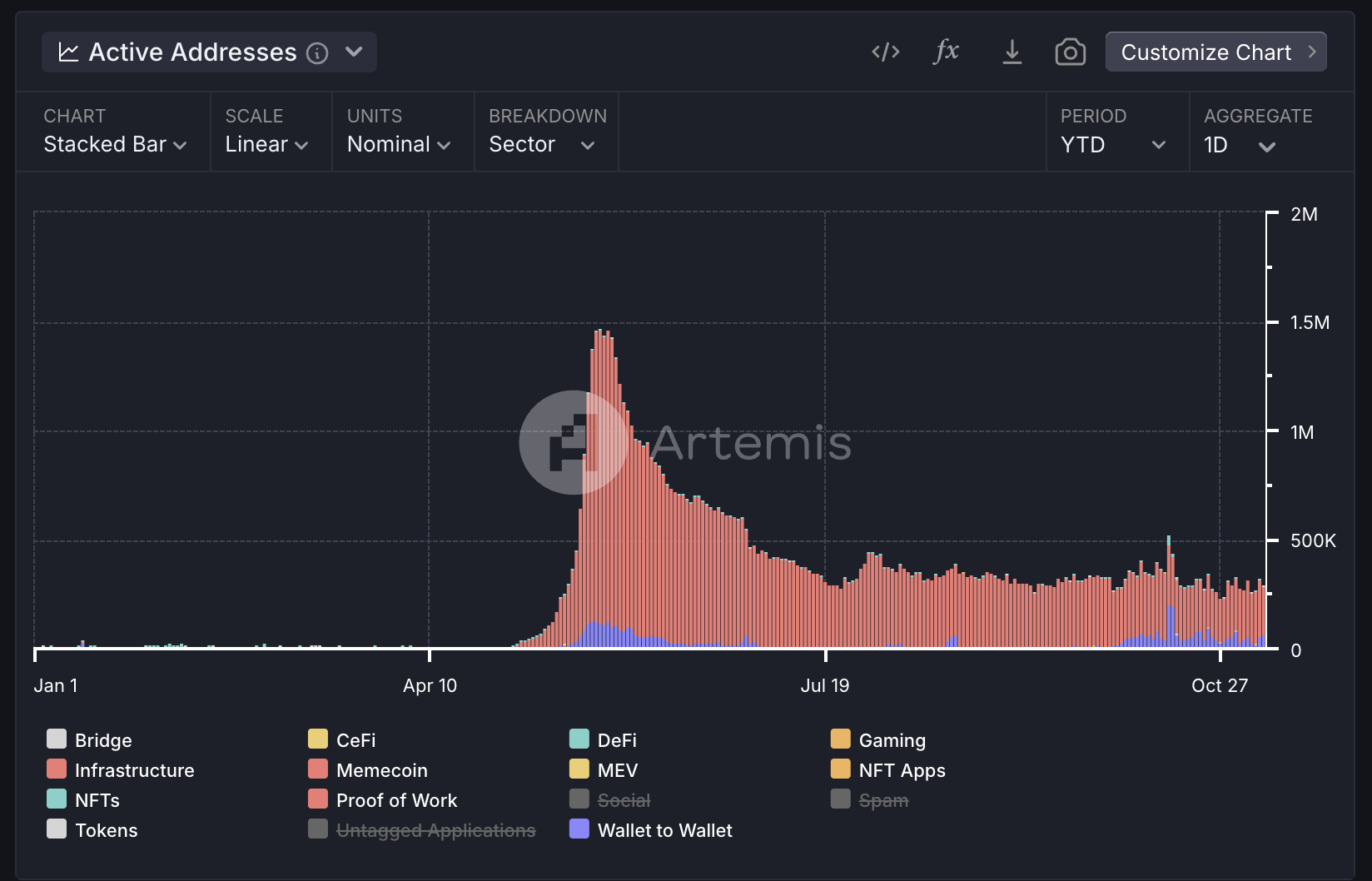

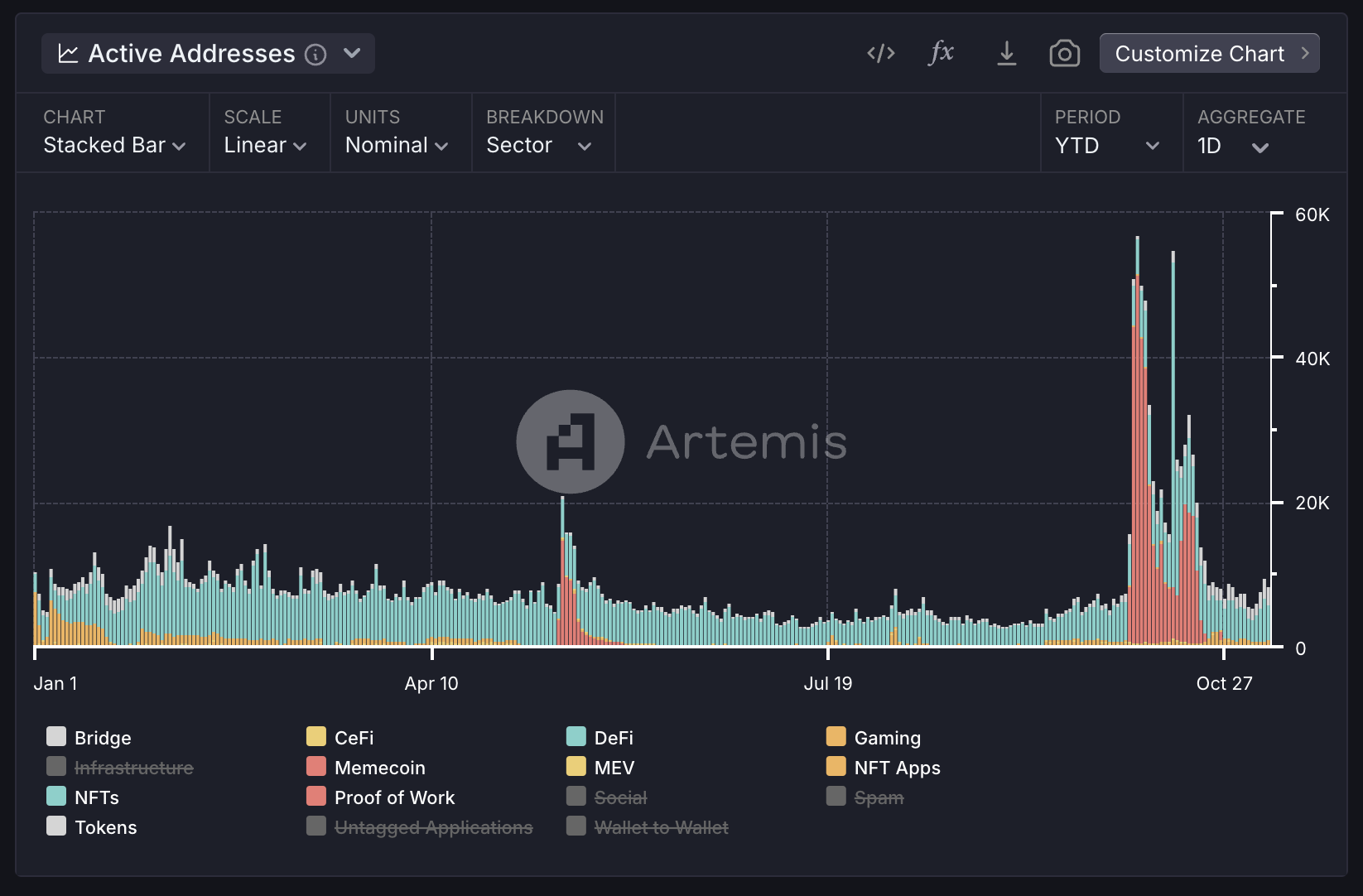

在用户数据上,Sui的总活跃用户数量有所上升,但活跃用户主要集中在Social板块,主要活跃Dapp为RECRD、BIRDS、FanTv等,这些Dapp在市场上的讨论量并未同步上涨,因此到底有多少真实用户依然有待商榷。去除Social板块以及BIRDS所属的Other板块,后的Sui生态的用户活跃度并未有太大的上涨,尤其是DeFi板块的日活跃钱包数量仅有1-5K,相比于以太坊、Solana等以DeFi为主的用户结构来说,Sui生态的DeFi活动较弱,用户结构并不健康,究竟有多少真实活跃用户依然存疑。2024年10月见证了Sui生态的Memecoin活跃期,相关的每日活跃用户峰值超过50K,但这一热潮并未持续,目前Meme的活跃度再次跌至低谷。

2.6 代币经济学与价格走势

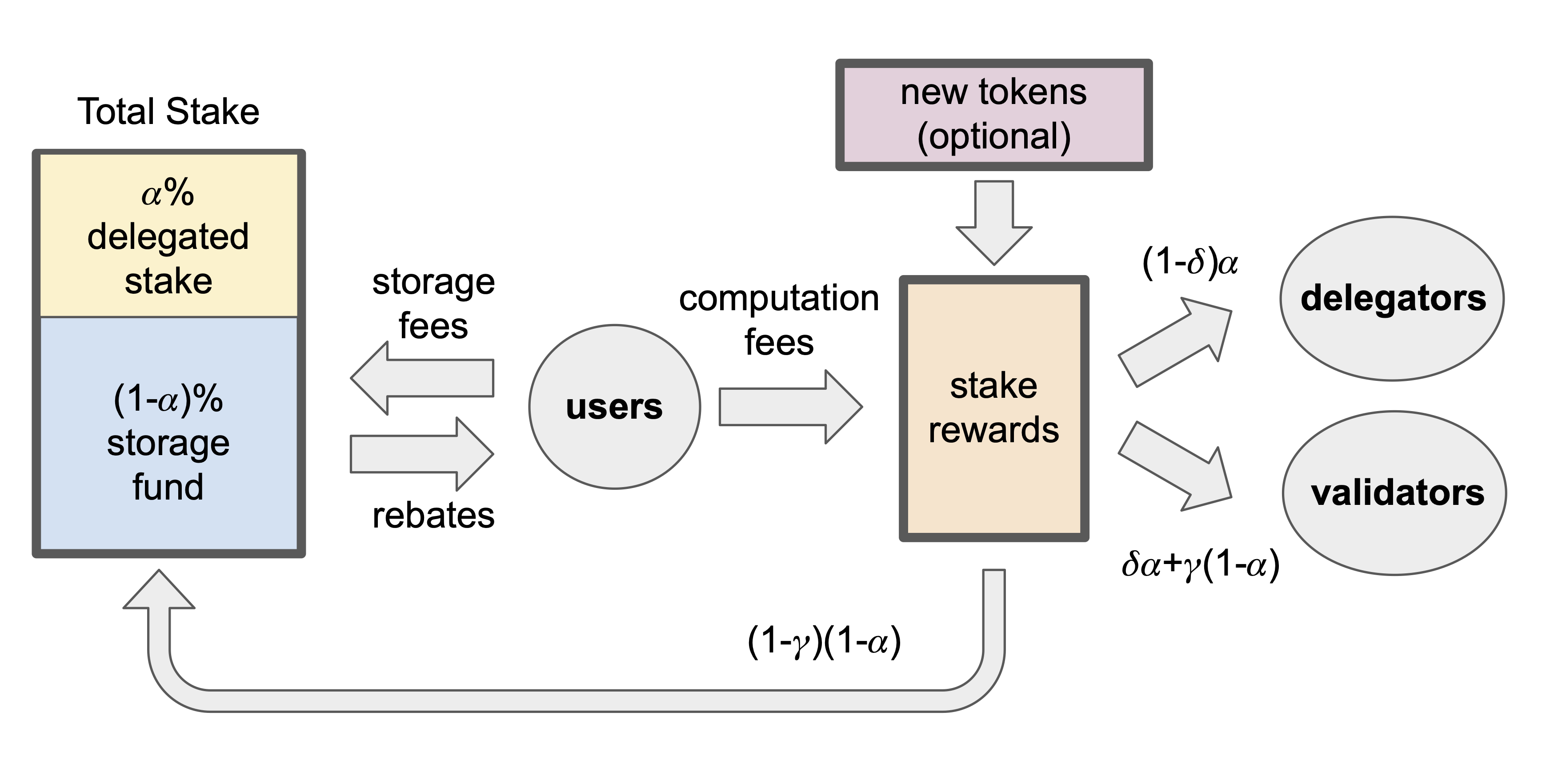

SUI在整个系统中的流转过程如下图所示。Sui设有Storage Fund,将同时获取用户支付的Storage fees和Stake Rewards中的一部分。每个Epoch的资金流转如下:

- 用户提交交易,并支付相应的Computation fees和Storage fees,其中Storage fees直接进入Storage fund

- 新的SUI代币通胀和Computation fees共同组成Stake rewards

- 每轮的总质押量包括两个部分:用户的质押量*α%*和Storage fund的比例(1-α)%

- 将γα比例的Stake rewards分配给质押者和委托质押者

- 剩余*(1-γ)(1-α)*的Stake rewards转入Storage fund

- 如果有用户删除了存储数据,Storage fund将会将部分存储费用返还给用户

因此,Storage fund在Sui生态发展的早期,除了返还删除数据的存储费用外,没有资金流出,形成对于SUI的锁定机制,当锁定部分超出代币通胀时,SUI代币进入通缩模式。

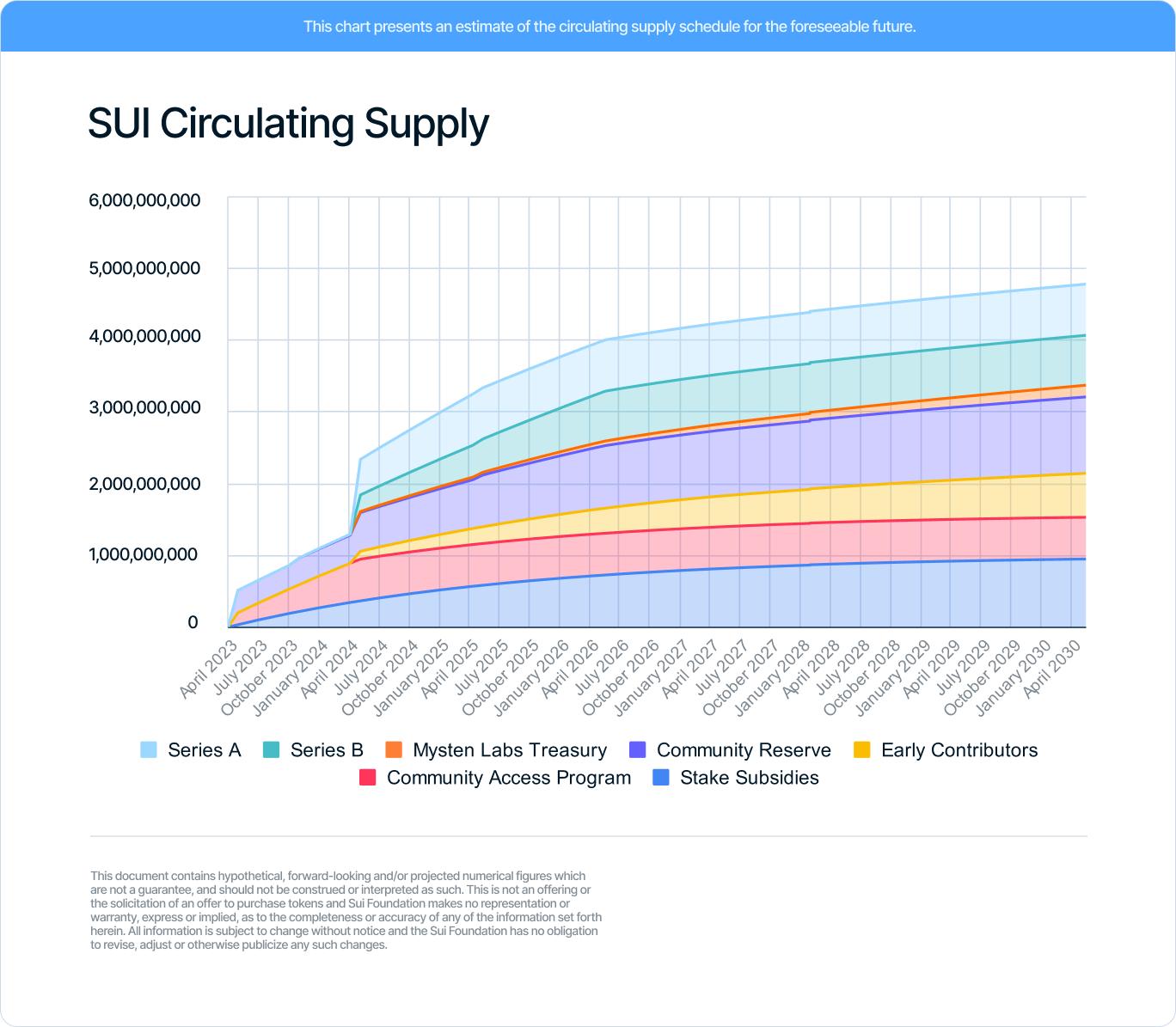

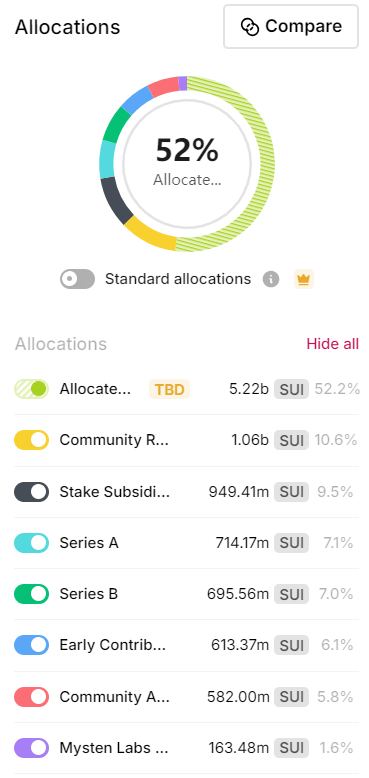

在代币分配上,SUI的总供应量为为10B,2023年6月29日Sui公布的代币解锁时间表如下图所示。根据Token Unlock数据,SUI的代币分配情况如扇形图所示。SUI的流通供应量为2,763,841,372.61,占比27.64%,目前,SUI的主要通胀压力来自质押奖励和代币解锁,自2024年4月开始,投资人、早期贡献者和团队代币开始每月解锁,2024年11月1日共解锁64.19M的SUI代币,占流通供应量的2.32%,持续的代币解锁和通胀可能会成为SUI上涨的压力。

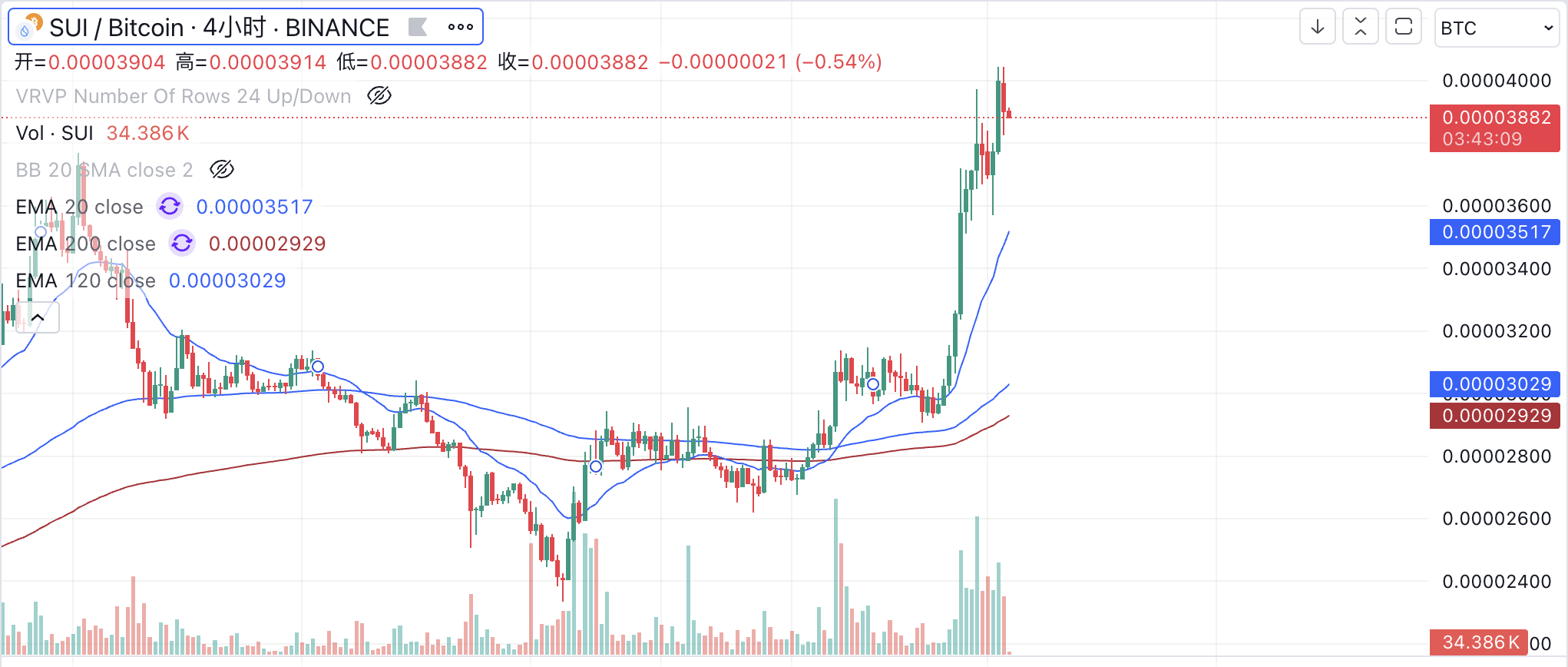

从价格表现来看,SUI对BTC的汇率走势非常强劲,在10月29日下挫至低点后快速回升,在经历一段调整后继续上涨,在11月9日后强势放量大幅上涨,并以突破了今年年初的高点。

2.7 小结

过去一个多月中,市场对Sui生态的关注度大大增加,这主要是由Sui及其生态代币的造富效应造成的,我们可以看到Sui及其生态正在形成合力,通过拉盘和利好消息释放来快速吸引眼球。那么Sui生态是否形成了“新的Solana”之势呢?

- 积极的一面是,正在看到资金流入Sui生态。虽然TVL的数据存在较大水分,但Sui的桥接资金净流入量位居第三,显示了Sui对链上资金的吸引力。

- Sui生态上在10月初诞生了不错的Memecoin,并且获取了一定的市场关注度,但势头和声量明显不足于Solana和以太坊,我们还没有看到对Meme的炒作资金有从以太坊和Solana上向Sui转移的迹象,且Memecoin的发展势头并不持久,用户活跃度再次跌至冰点。

- Sui依然将Web3 Gaming作为自己的主要战略之一,但Gaming在这一轮并不乐观,被看作是Mass Adoption的TON生态小游戏也在被逐渐证伪。如果Sui的生态项目在这一轮造势之后无法承接,Sui生态可能依然难逃被市场遗忘的命运。

- Sui的日活用户总量大幅增长,但拆解来看并不健康,甚至可能存在水分,与生态战略一样,这让我们对Sui生态的健康性和持续性保持谨慎态度。

- 从代币来说,SUI面临着长期、持续的通胀压力,这会对其币价的上涨造成很大压力。很多人将SUI比作新的SOL,但SOL在本轮上涨时已基本解锁完毕,没有太大通胀压力,需要持续监控SUI的筹码结构和解锁情况,如果公链本币突破受阻,会对生态的持续发展造成较大压力。

3 Aptos生态解析

3.1 公链基本信息与近期进展

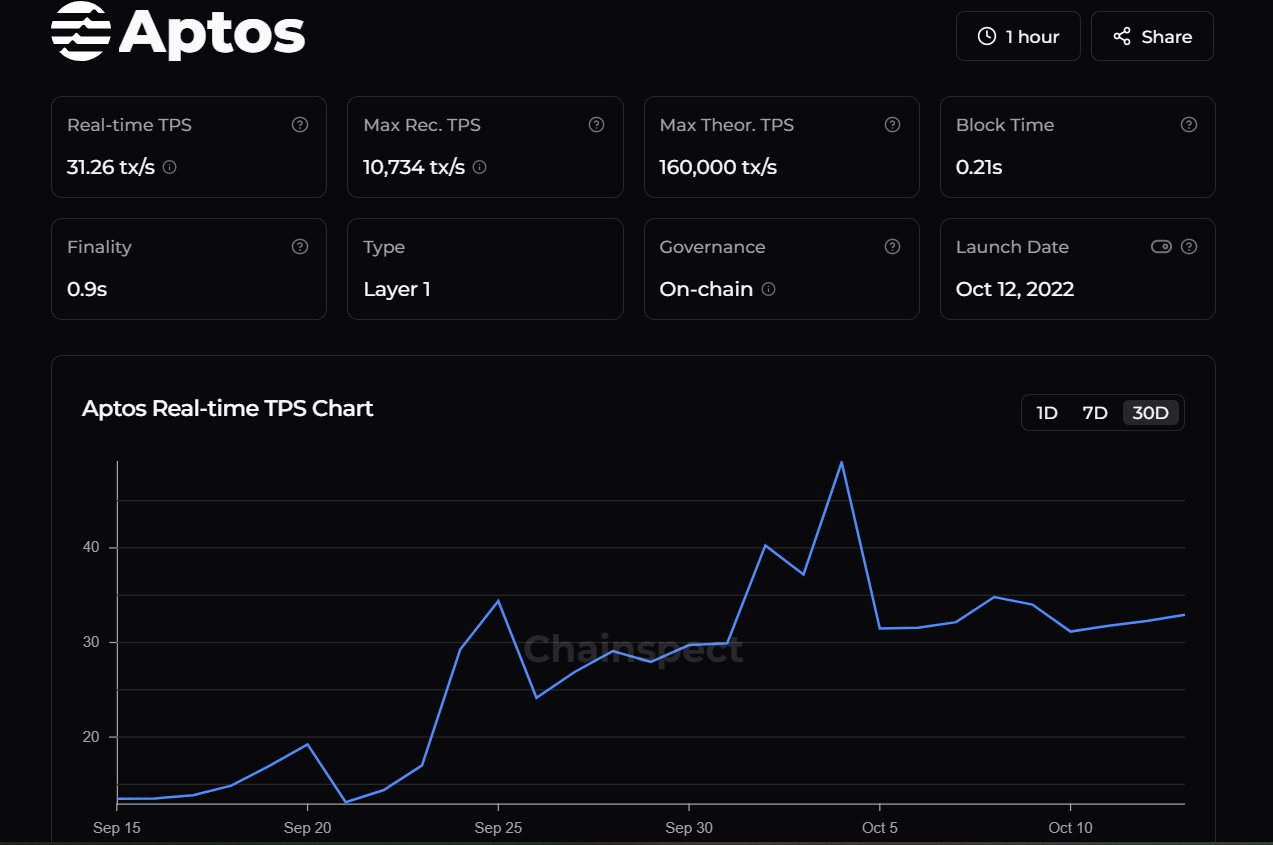

Aptos同样是基于Move语言的Layer1高性能公链,但相比于Sui,Aptos保留了更多Diem的核心,而Sui则引入了更多修改。二者最大的差别是Sui引入了基于对象的模型,而Aptos采用的是基于账户的模型,此外在交易的并行执行策略上也存在一定差异。总结来说,Aptos更注重模块化涉及和传统区块链结构的优化,而Sui则在架构上提出了更大的创新。在性能上,根据Chainspect数据,Aptos的理论最高TPS可达到160,000,在实际运行中最高记录TPS为10,734,日常的TPS保持在500-1000。

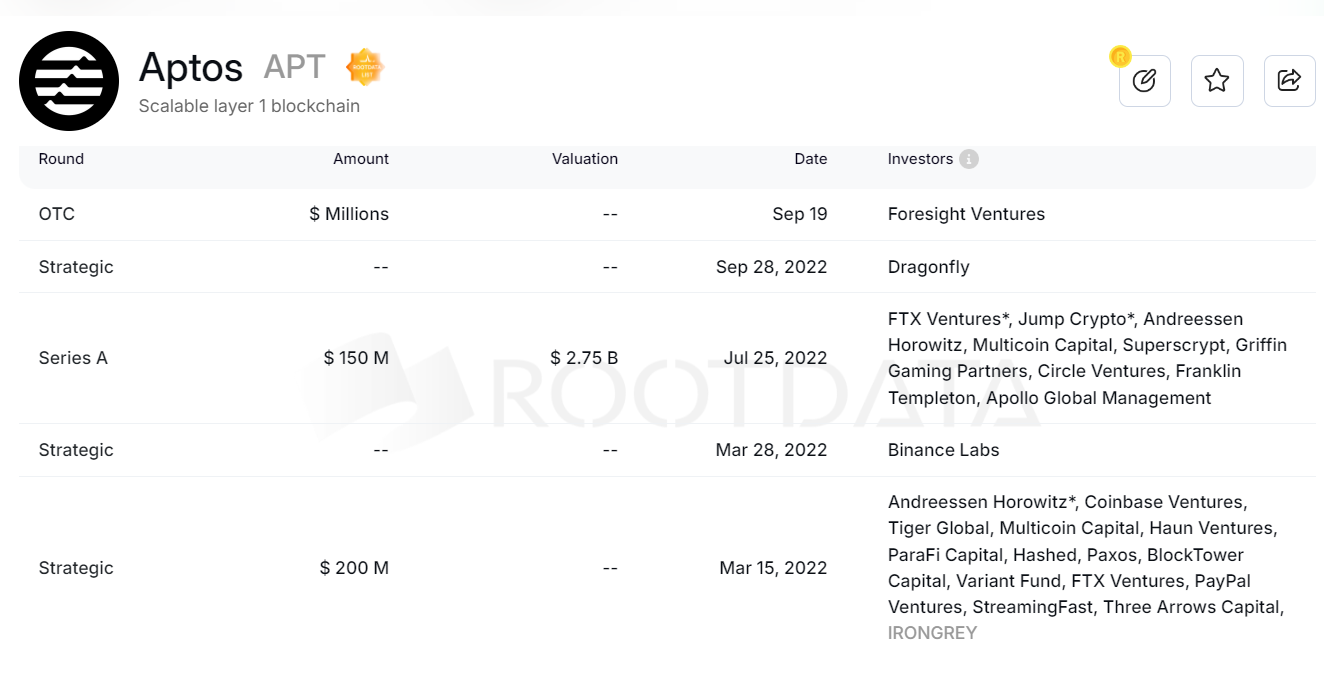

在融资背景上,Aptos在2022年公布了多轮融资,A轮融资估值$2.75B,同样得到A16z、Binance Labs、Coinbase Ventures等头部基金的支持,2024年9月19日,MEXC Ventures、Foresight Ventures 和 Mirana Ventures 共同推出了一只基金,以支持在 Aptos 生态系统中启动的项目。

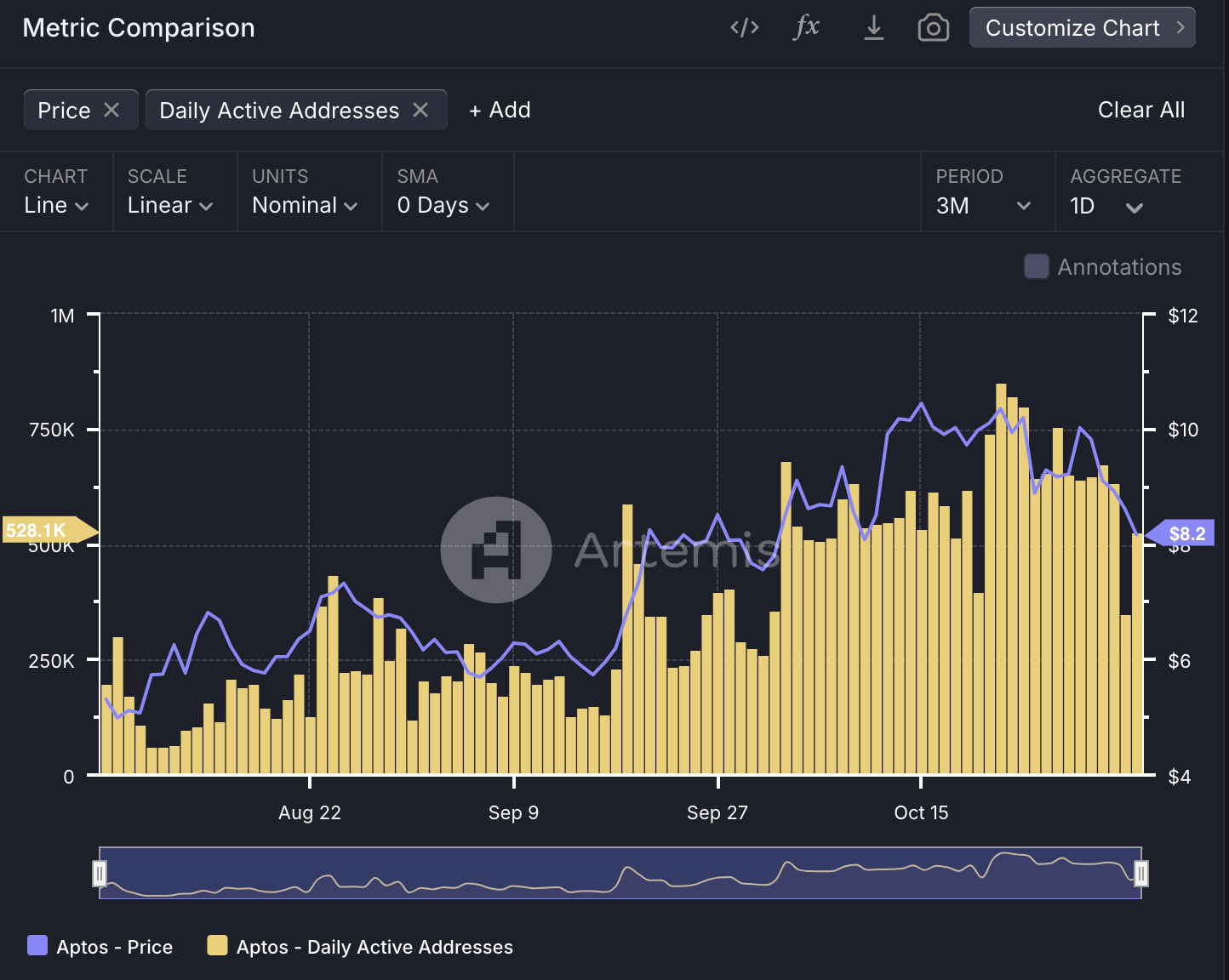

Aptos主网上线于2022年10月17日上线,在2024年之后TVL开始快速上涨,自今年年初以来上涨超过3倍,目前在所有公链生态中位居第12位,同样形成了比较完善的DeFi基础设施生态。Aptos在主网刚上线的一个月内的日活跃用户较多,随后陷入了为期半年多的沉寂,直到2023年8月后才恢复了一定的用户活跃度,目前的每日活跃地址数量在500-600K左右。

APT在2024年8月5日的低点后上涨了超过一倍,但距离其ATH价格仍然具有一倍的距离。Aptos在最近并没有比较轰动性的利好,生态主要进展包括:

- 2024年9月19日,MEXC Ventures、Foresight Ventures 和 Mirana Ventures 共同推出了一只基金,以支持在 Aptos 生态系统中启动的项目。

- 2024年10月3日,Aptos Labs 宣布通过收购 Palette 链开发者 HashPalette 公司战略性扩展至日本市场,将推动 Web3 在日本娱乐、游戏和数字资产领域的普及。

- 2024年10月2日,富兰克林邓普顿将链上货币市场基金扩展至Aptos网络。

- 2024年10月28日,原生USDT上线Aptos主网。

3.2 本位交易活跃度

Aptos上几乎没有实现本位交易的手段,没有活跃和龙头的Memecoin,整个生态还比较初期。

3.3 生态系统概览

根据Aptos官网,目前共有192个项目,远超Sui的数据,其中根据DeFillama数据,共有DeFi协议49个,在数量上和Sui生态基本相当。但Aptos生态已发币的项目比较少,市值前1000中生态原生发币项目只有Propbase(RWA平台)和Thala,此外Cellana的代币CELL市值排名仅1300多名。

-

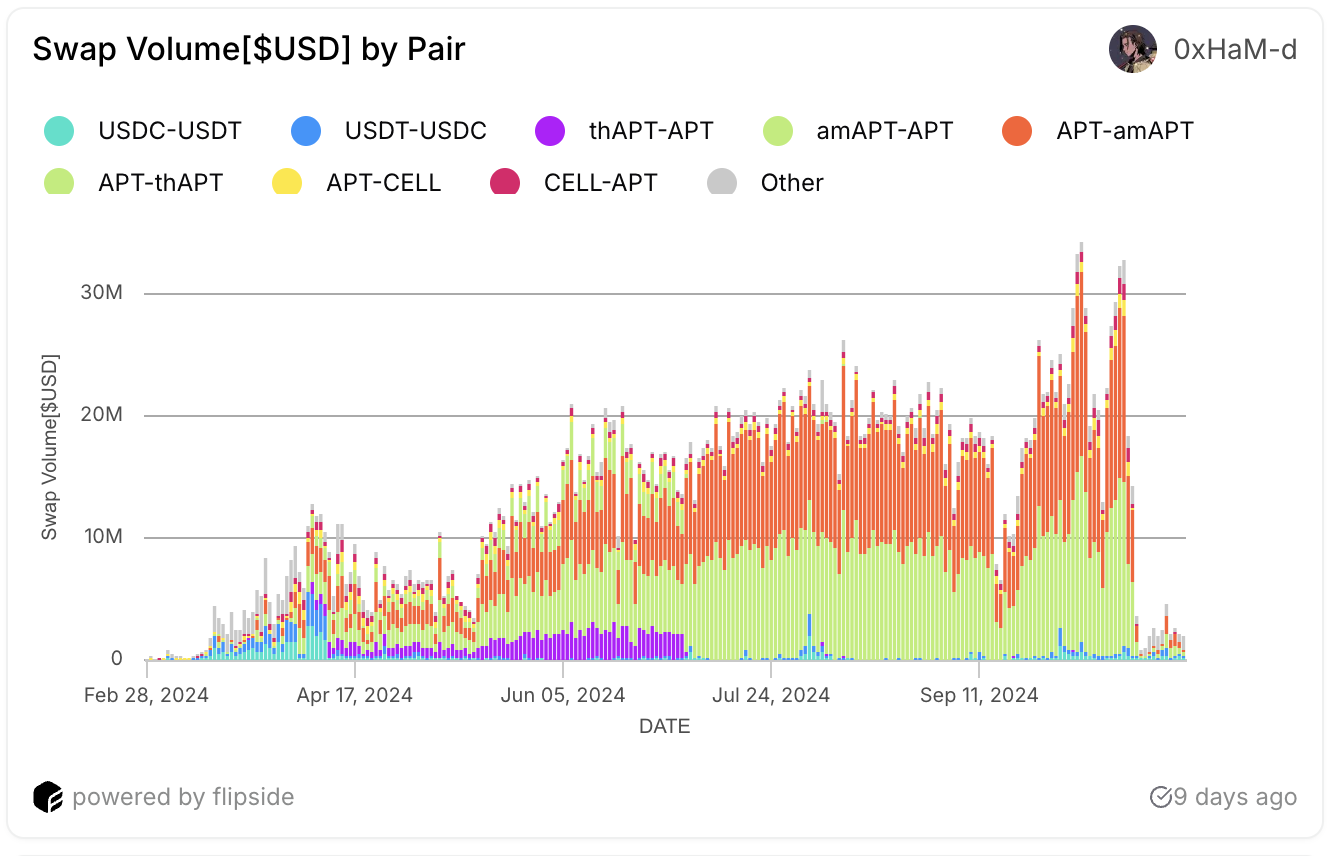

Thala:Aptos上的龙头DEX,构成了Aptos链上的交易量的50%,核心产品包括Swap、流动性质押和超额抵押稳定币。Thala目前在交易上功能较为单一,仅以AMM交易为主,此外开放了流动性质押,用户可以获得流动性代币thAPT,并将其质押获得约8%的APR。Thala是Aptos上原生稳定币MOD的发行商,用户通过超额抵押APT、thAPT和sthAPT来mint MOD。从交易量上,相比于其他两个DEX(LiquidSwap和Cellana Finance),Thala近期的交易量数据表现最好,其中构成主要交易量的代币对为MOD/zUSDC(LayerZero’s USDC),24小时交易量约为6M美金,显示了MOD稳定币对Thala的赋能,此外交易量较高的也为稳定币和APT及衍生资产的交易对。THL代币于2023年6月上线,仅上线MEXC和Gate交易所,主要交易量集中在链上的THL/MOD交易对,THL的币价在2024年3-4月份达到峰值约3美金,目前回落至0.8美金左右。

-

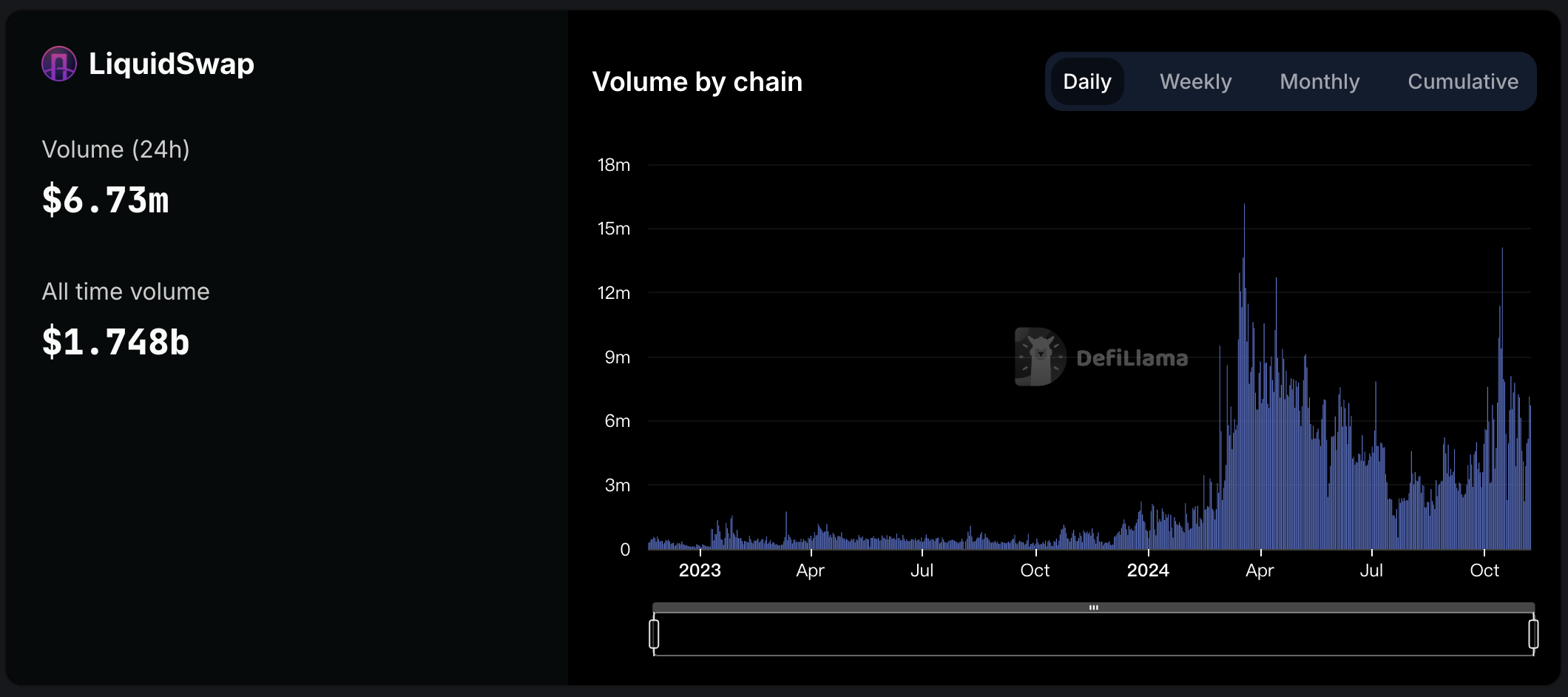

LiquidSwap:Aptos上的龙二DEX,占Aptos链上交易量的22%,该DEX由Pontem Network 开发,其最主要的交易对是USDC-APT,24小时交易量为3M,TVL约为20M,占LiquidSwap上交易量与TVL的一半。

-

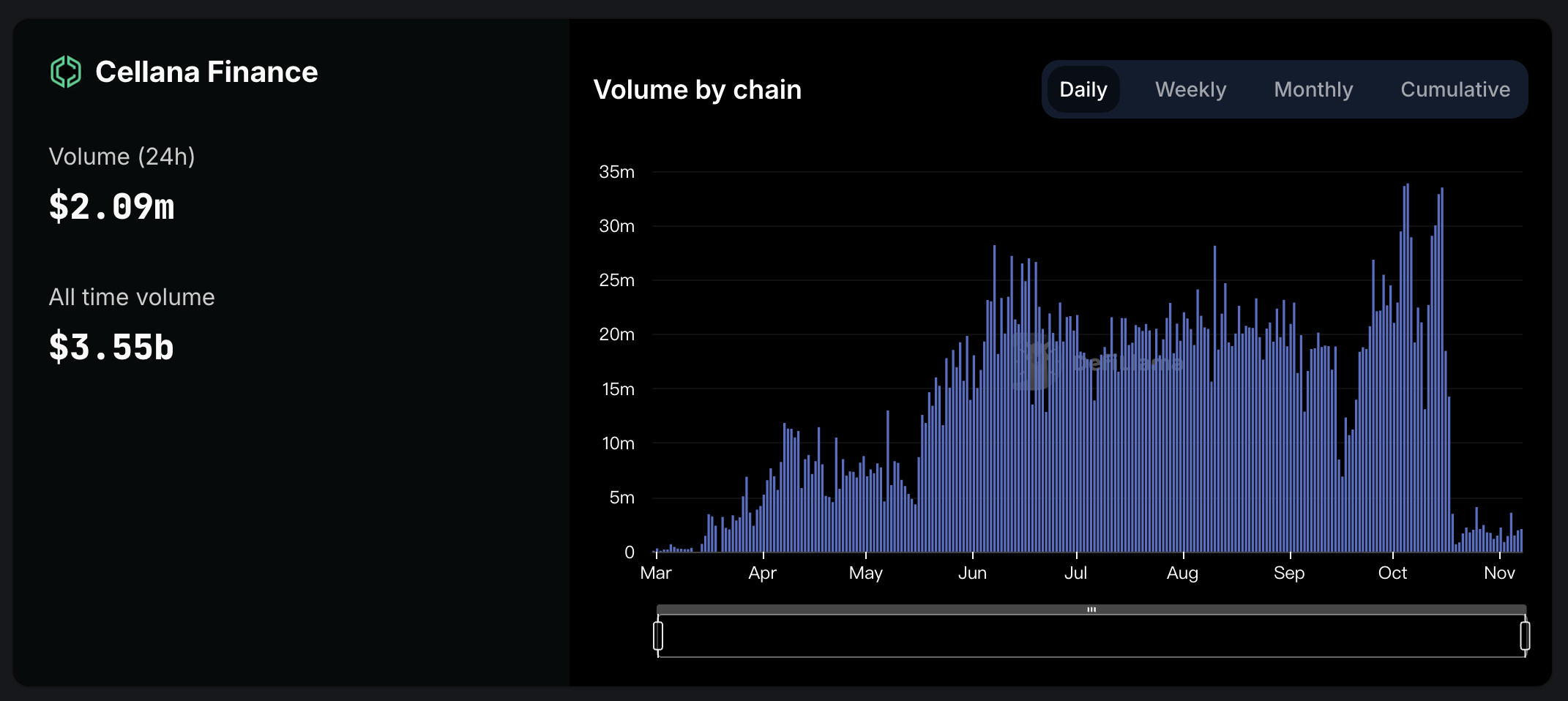

Cellana Finance:Cellana于2024年2月上线,但已经是Aptos上累计交易量最高的DEX,2024年1月到10月保持着每日超过25M的交易量,但在10月18日后交易量骤减,目前的每日交易量仅剩2M左右,之前其交易量主要来自于amAPT-APT之间的相互兑换,但这一交易对的交易量在10月18日后大幅下降。Cellana是Aptos是为数不多已经发行代币的协议,其代币CELL可质押获得veCELL,根据质押时间可获得一定的投票权,决定下一轮CELL流动性激励在不同池子中的分配,veCELL投票人将获得该时间段内所投票流动性池100%的交易费用。CELL目前只能在Cellana上交易,CELL-APT交易对占其总交易量的88%。

-

Aries Markets:Aries是Aptos生态中最大的借贷协议,也是TVL最高的DeFi协议,目前总供应贷款金额为$664M,共借出$402M,TVL在过去两年内实现了显著增长,主要的资产类型为zUSDT、zUSDC、stAPT和APT,其中zUSDT、zUSDC的存款可以获得12%的年化收益率,主要来自于APT的补贴,是Aptos上稳定币的主要生息场所之一。除借贷功能外,Aries集成了AMM、限价单交易和跨链桥。Aires目前尚未发币,但正在进行积分计划,奖励存款与借款的用户。

-

Amnis Finance:Amnis是Aptos上最大的流动性质押协议,用户存入1APT可获得1amAPT,将amAPT质押可得到stAPT,获得相应的质押收益,约为9%。该协议于2023年10月上线,TVL一直稳步增长,是Aptos上TVL第二的DeFi协议。amAPT和stAPT已经在Aptos生态中得到了广泛集成。从2023年11月开始,Amnis推出积分和回溯性空投计划,并明确说明了积分将于AMI代币的空投直接相关。

-

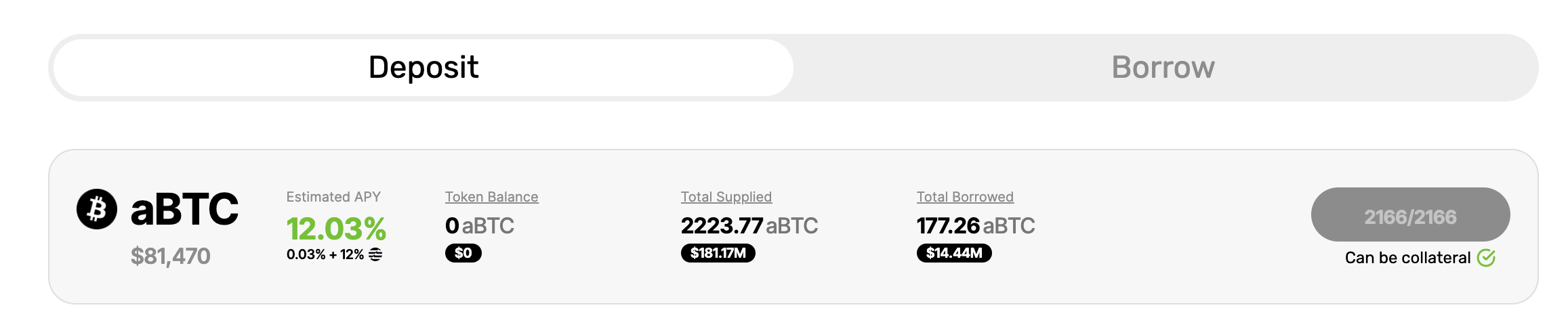

Echo Lending:Echo通过将Bsquared Network上的BTC资产桥接到Aptos,在Move生态中引入BTC资产,并获得多层收益。具体来说,Echo将BTC L2的uBTC桥接到Aptos上,获得aBTC,用户可将aBTC在Echo协议中借出,获得APT的补贴收益,在这一过程中用户可实现一鱼多吃:Bsquared积分、Echo积分和APT奖励,目前借出aBTC可获得年化12%的APT补贴,但已经达到存款上限。Echo自上线Aptos后TVL快速增长,目前已经超过170M,是Aptos上TVL排名第四的协议。

3.4 生态发展战略

在生态战略上,Aptos和Sui有着不同的关注点,Aptos近期的发力点包括RWA、比特币生态和AI。

RWA:Aptos正在积极推进现实资产代币化和机构金融解决方案。2024年7月,Aptos官宣将Ondo Finance的USDY引入生态,并于主要的DEX、借贷应用集成,截止11月10日,USDY在Aptos上的市值约为1500万美元,约占USDY总市值的3.5%。2024年10月,Aptos 宣布富兰克林邓普顿已在 Aptos Network 上推出以 BENJI 代币为代表的富兰克林链上美国政府货币基金(FOBXX)。此外,Aptos也和Libre达成合作推行证券代币化。

比特币生态:Aptos积极切入BTCFi,通过将BTC L2上的比特币资产接入Aptos生态,来提高Aptos上的资产多样性,并做大TVL。2024年9月,Aptos官宣了与Stacks的合作,将sBTC引入Aptos网络,但sBTC目前还未与主流DeFi协议有效集成,这一战略对Aptos的作用还有待观察。此外,Aptos通过Echo协议实现了与Bsquared Network,目前引入的BTC资产已超过170M美金,Aptos提供了高额的APT激励(年化12%)来刺激BTC资产的跨链和存款,展现了Aptos生态对吸引BTC资产战略的重视程度。BTC资产的引入将提高Aptos上TVL增长和DeFi协议的发展上限,需持续关注相关资产TVL和Aptos官方的激励措施的变化。

AI:Aptos在AI的发展还处于非常早期,2024年9月,Aptos发文宣布与 NVIDIA、Tribe 和 DISG 支持的 Ignition AI 加速器达成合作,以推动亚太地区及其他地区的 AI 初创公司的发展。

3.5 资金与用户数据变化

在资金数据上,Aptos的TVL和稳定币市值都保持着较为健康的增长态势,以美金计算的TVL在四月初达到高点,后因为APT及其生态代币价格的大幅下跌而下降,但以APT计价的TVL则一直保持上涨态势。从9月18日开始到10月22日的高点,以USD计价的TVL增长了一倍,目前因为APT价格的下跌出现小幅回落,以APT计价的TVL从70M APT增长到90M APT。追踪这一个月内TVL上涨的原因主要有两个:一是APT价格的上涨,且APT是其生态TVL的主要资产;二是Echo lending的上线,迅速吸引14.7M APT的的TVL,构成了增量20M的主要部分。因此,Aptos这一个月的TVL看似大幅上涨,其实对生态流动性的贡献有限。

Aptos生态的稳定币以USDC为主导,稳定币市值从2024年初的$50M稳步上涨至现在的$292.41m,上涨超过四倍,且依然保持上涨趋势。

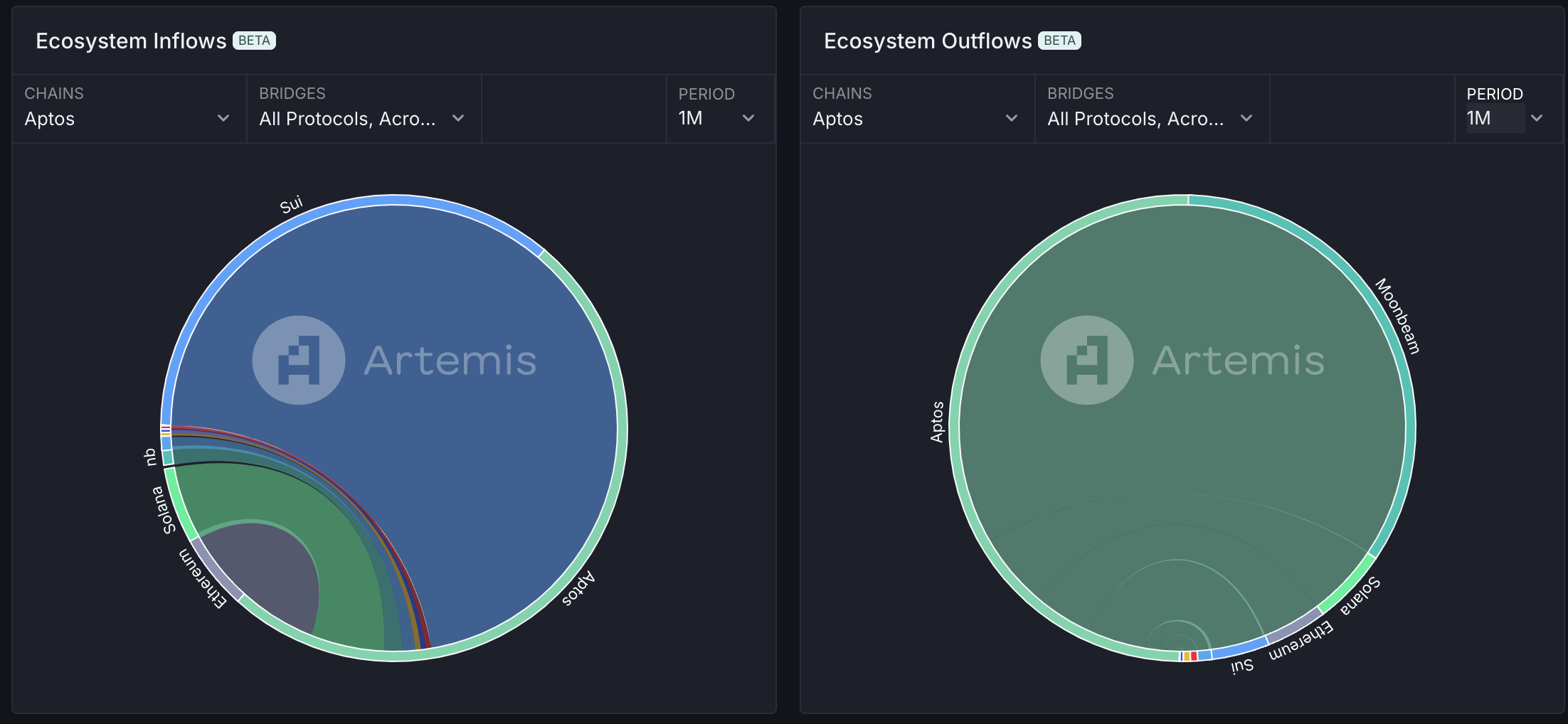

在资金流入情况上,Aptos在三个月内的资金呈现净流入,流入资金约为$3M。近一个月内,Aptos的主要资金流入来自于Sui,此外来自于Solana和以太坊,资金流出的目的地主要为Moonbeam,总结来看,Aptos在资金面上较为健康,生态内的资金量正在增加,但并未看到承接其他生态(尤其是以太坊和Solana)资金溢出的趋势。

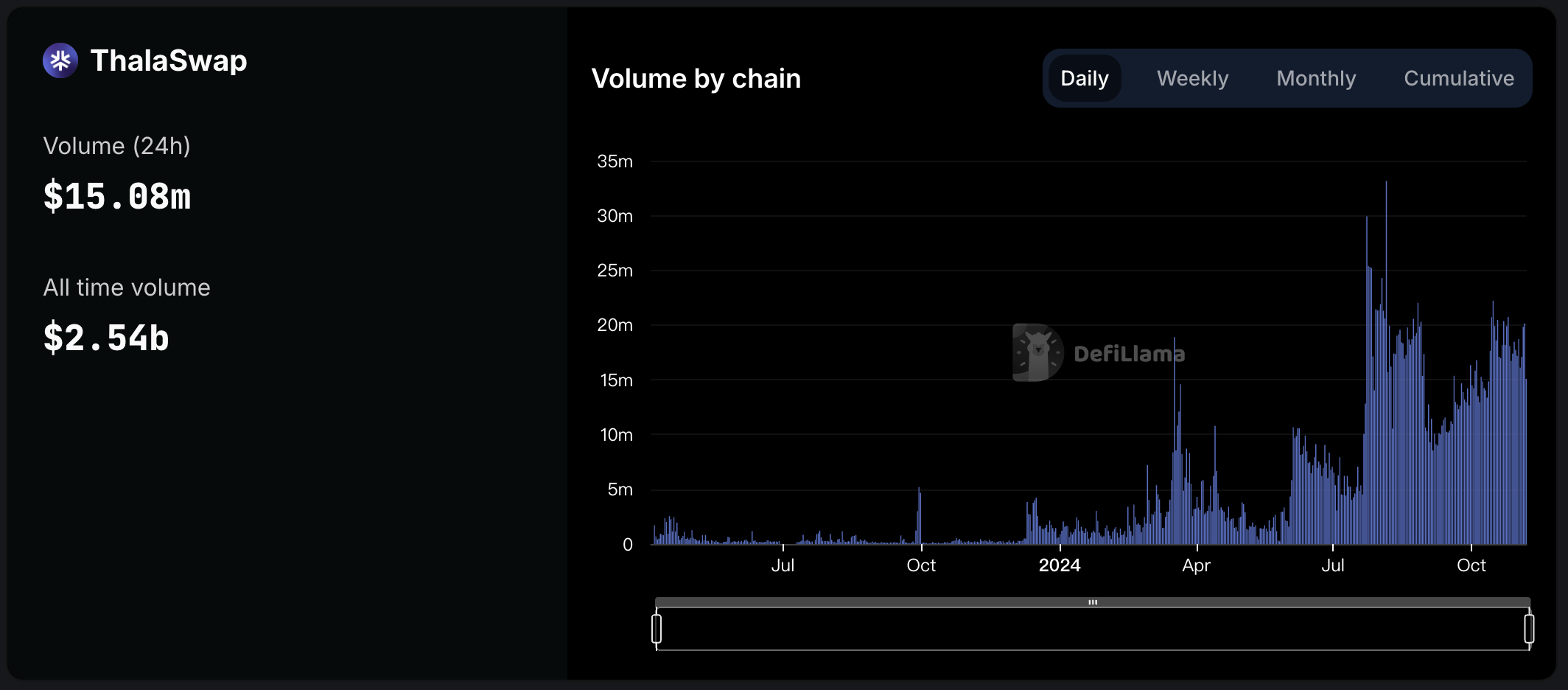

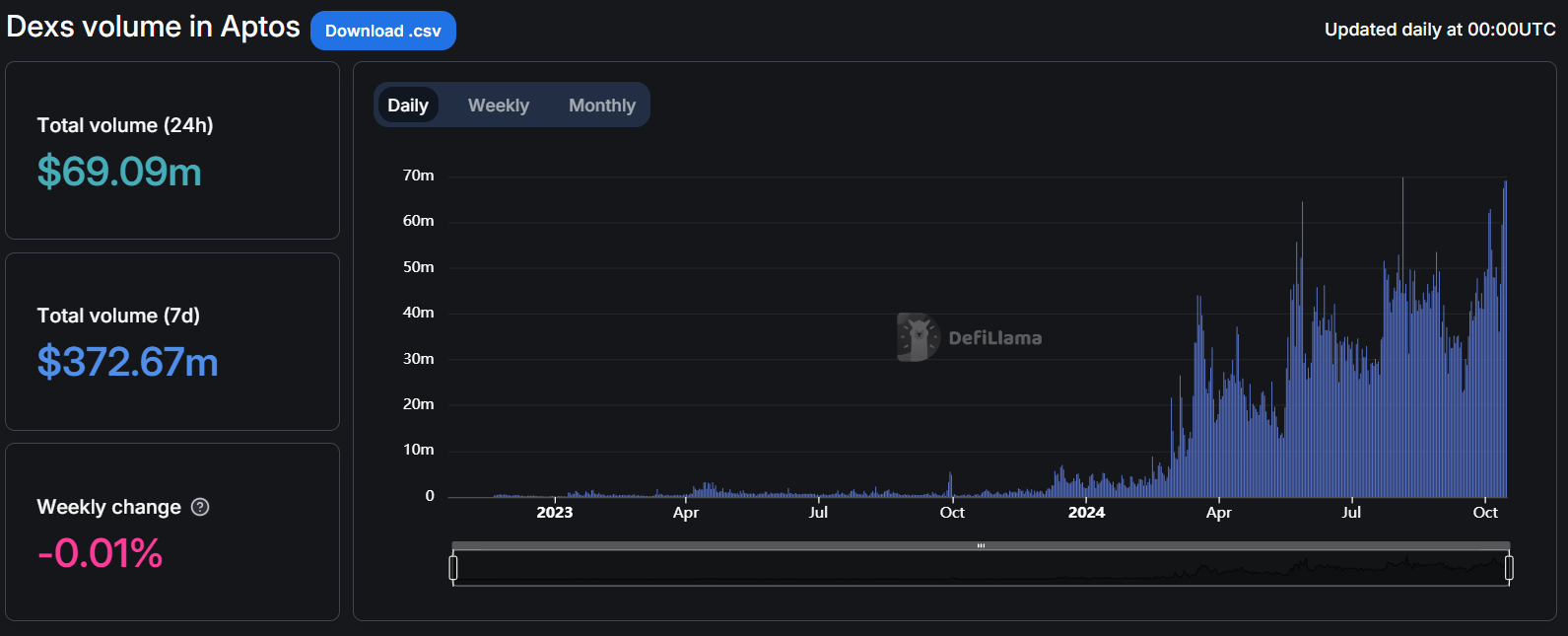

在交易活跃度上,Aptos的DEX交易量在所有公链生态中处于第12位,交易量在2024年4月后开始大幅增长,目前仍保持在相对较高的水平,交易主要集中在Thala和LiquidSwap上。

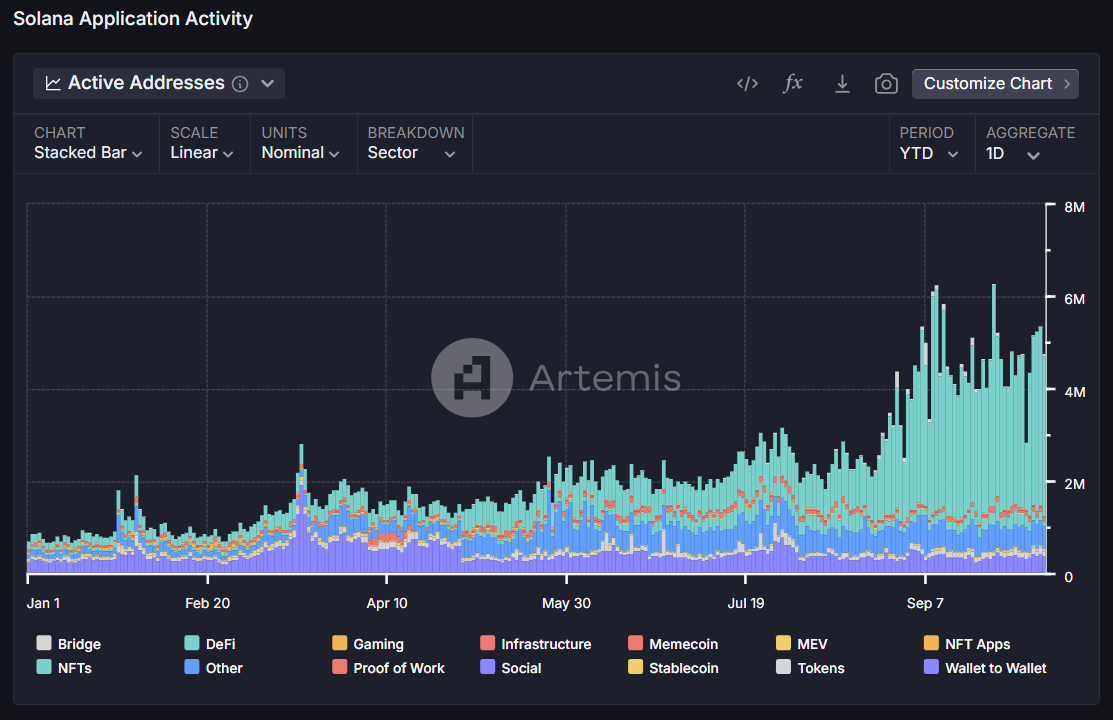

在用户增长上,Aptos的日活数量在10月底达到了生态发展的顶峰,日活钱包数超过800K。根据DappRadar数据,Aptos生态上活跃用户最多的应用包括Kana Labs、Chingari、STAN、KGeN和ERAGON,而活跃用户最高的DeFi基础设施项目Aminis仅有6k UAW(相比之下Kana Labs的活跃用户数量超过150k),DEX的活跃用户甚至只有1k,显示出Aptos并没有进入健康的生态发展,链上的交易用户非常低,用户进入Aptos生态交易和投机的需求都很低。(对比Solana的用户数据,第一名Raydium的UAW超过3M,第二名Jupiter的UAW为251K,远超其他项目)

3.6 代币经济学与价格走势

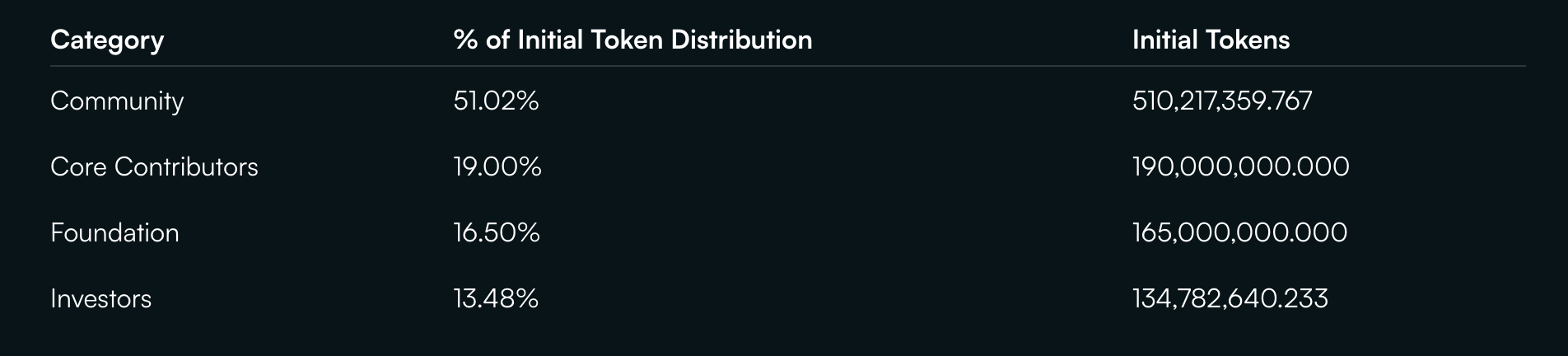

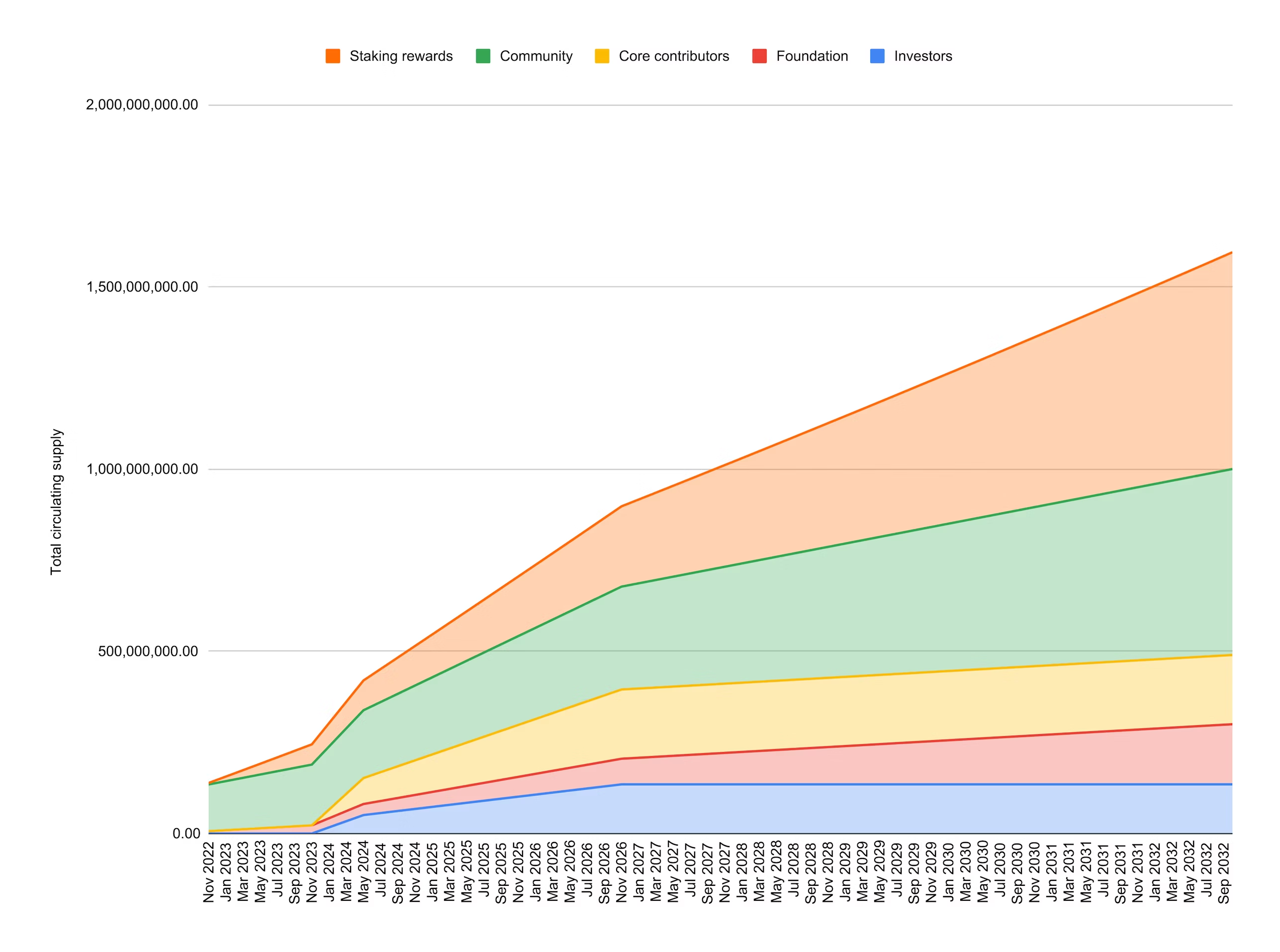

APT的初始代币供应量为10B,分配比例和时间表如下图所示。其中虽然有51.02%的比例分给社区,但这些代币初始主要集中在基金会手中,410,217,359.767由基金会管理,100,000,000由Aptos labs持有,其中125,000,000将用于生态项目激励,其余的分配较为不明确。针对核心贡献者和投资者,一年锁仓后将进行线性解锁。目前的主要代币解锁来自社区、基金会、投资者和核心贡献者,每月解锁代币11.31M,抛压相对来说比较大。

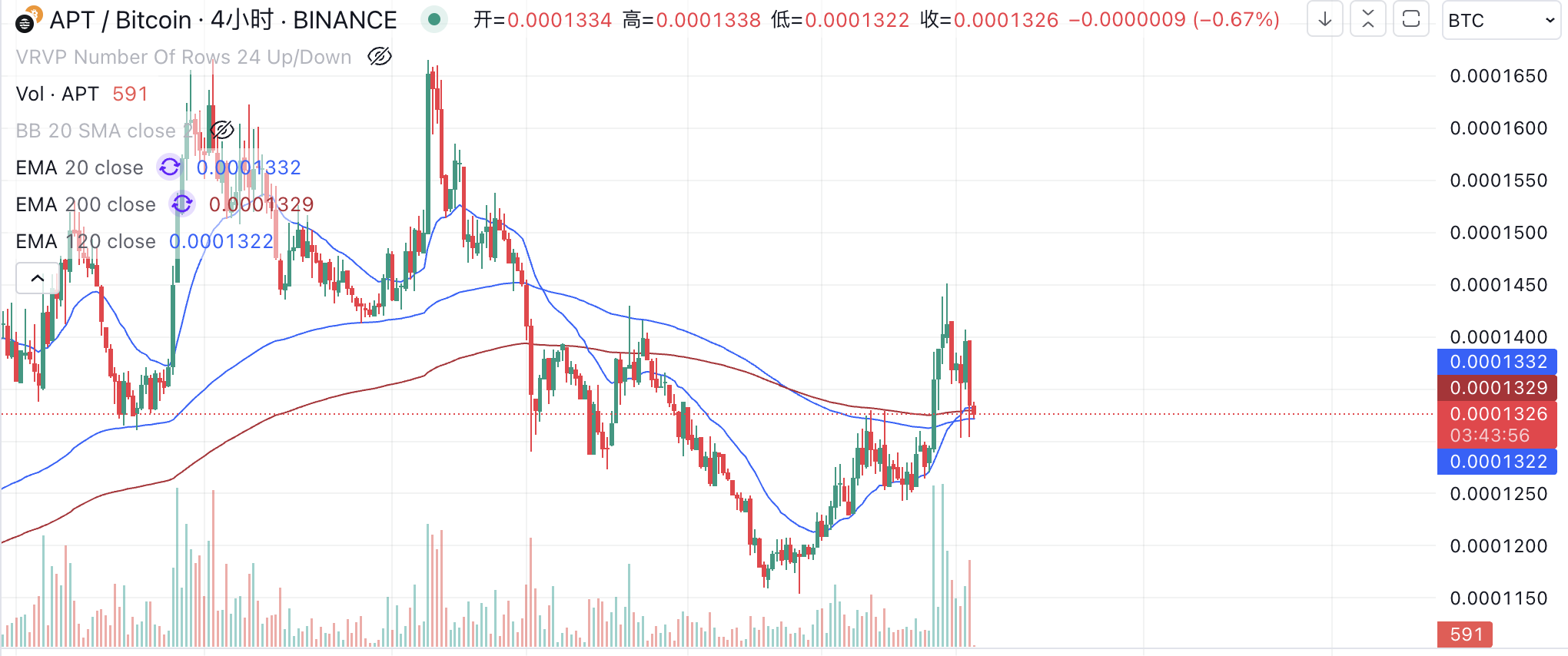

从价格走势上看,APT对BTC的走势稍显弱势,从2024年初下降后一直处于低位,在9月-10月迎来了一定的上涨后,在10月29日急速下挫,目前随出现小幅上涨,但并未突破10月初对BTC的高位,与今年年初的高位也依然有较大差距。

3.7 小结

作为与Sui齐名的Move双子星,Aptos在过去一段时间也获得较大的市场关注,与Sui相比,谁能成为Solana Killer的争论也一直不断,在此对Aptos生态的发展进行小结:

- Aptos的TVL正在大幅上涨,同时保持着资金的正向流入,但流入量远小于Sui。

- Aptos的生态发展极为初期,链上交易标的少,没有高市值的Memecoin,因此链上交易量和交易活跃度极低。

- Aptos将RWA和BTCFi作为生态发展战略的核心,希望打开新的资金入口来做大生态TVL,可以对相关资产的市值增速以及和Aptos DeFi应用的集成情况保持跟踪。

- 与Sui相同,Aptos的用户结构同样存在不健康的问题,DeFi用户的数量较低。

- 从代币来说,APT同样面临着较高的解锁抛压,可能会对价格上涨形成一定阻力,同时从价格表现上来看,在短期内的价格走势并不如SUI强势,而是呈现与SUI的跟涨趋势。

4 小结:Sui生态与Aptos生态对比

| 公链 | Sui | Aptos |

|---|---|---|

| MC | $8,963,108,373 | $5,577,149,571 |

| FDV | $31,496,463,786 | $12,068,813,424 |

| TVL | $1.383B | $996.28M |

| 稳定币市值 | $388.29m | $292.6m |

| DEX交易量(7d) | $2.019b | $208.58m |

| 近一个月资金流入 | $168,226,279 | $1,162,500 |

| 资金流入来源 | Ethereum | Sui |

| 资金流出去向 | Ethereum | Moonbeam |

| 协议 | 所属生态 | TVL | DEX Volume(7D) | MC | FDV |

|---|---|---|---|---|---|

| Thala | Aptos | $238.36m | $107.28M | $41,772,087 | $84,660,614 |

| Aries Markets | Aptos | $275.95m | - | - | - |

| Cetus AMM | Sui | $251.77m | - | $244,998,242 | $405,278,557 |

| NAVI Protocol | Sui | $453.36m | $1.688B | $61,801,250 | $194,312,795 |

| Suilend | Sui | $402.82m | - | - | - |

上表列出了Sui和Aptos生态的主要数据对比,以及二者主要DeFi协议的数据对比,在此我们对两个生态的对比研究做一个小结:

- TVL方面,二者差距不大,且SUI价格的涨幅最近远超APT,生态代币的市值也更高,也是Sui在TVL上领先于Aptos的一个重要原因。Sui和Aptos在近期都实现了TVL的新高,但主要来源于生态代币价格上涨,背后的有机增长其实非常有限。

- 资金流向方面,Sui生态持续有大量资金净流入,目前仅次于Base和Solana生态,Sui主要承接了来自以太坊上的资金,相比之下Aptos的资金净流入非常有限,只有Aptos的不到1%,且资金主要来自于Sui,说明Sui目前是Move生态的主要入口,而Aptos主要承接来自Sui的资金溢出,且这种资金溢出效应非常弱。

- 链上活跃度方面,Sui生态的DEX交易量是Aptos的10倍,显示了Sui生态上更高的交易活跃度。但在用户活跃度上,二者的DeFi用户活跃度均比较低,相比于Solana等成熟公链来说,用户结构的健康性还远远不够。

- 生态发展方面,Sui在10月经历了本币和生态代币的强势拉盘,并积极推进生态项目上所,NAVX上线Bybit,Cetus上线币安,增强了市场关注度,也打开了对Sui生态的想象空间,本币和生态代币的拉盘也形成了整个生态短期内迅猛发展的合力。Aptos上的生态发展更弱,除了THL和CELL没有核心的生态代币,也没有发展Memecoin,虽然APT价格快速拉升,但生态代币并没有显著上涨。

- 生态发展战略方面,Sui在短期内通过Memecoin吸引了一部分链上资金,但热潮并未持续,长期的发展关注Web3 Gaming,Aptos则希望通过RWA和BTCFi引入更多资产进入生态,拉高生态的TVL,Echo在短期内实现了不错的效果。

- 代币解锁方面,SUI和APT都面临着比较大的月度解锁抛压。SUI每月解锁64.19M(约200万美元),占流通供应量的2.32%,APT每月解锁11.31M(约120万美元),占流通供应量的2.17%。

- 价格走势方面,在本次大选交易下,SUI的上涨势头更猛,快速突破上轮新高,也突破了今年来对BTC汇率的高点,而APT相对乏力,还没回到10月底对BTC的汇率水平。