Author: Kyle

Reviewer: Sandy

Source: Content Guild - News

Originally published on: PermaDAO

Original link: https://permadao.notion.site/AgentFi-Botega-DEX-80b8a24c84fc4207b35dc5ef16c8d1f6?pvs=4

Has the AgentFi era really arrived?

Autonomous Finance recently launched an AgentFi application - Botega, a DEX designed with "autonomous agent" as the core. It is fully decentralized, built on Arweve and AO, and is committed to creating a more transparent, open and accessible financial system.

The highlight of Botega is its autonomous proxy system, which can execute trading instructions without human intervention. Botega currently uses the AMM model of Uniswap V2, and will gradually introduce Uniswap V3 AMM and launch on-chain order book functions in the future.

Key features of Botega

What is special about Botega can be seen from the official introduction of Autonomous Finance. The official introduction calls the Autonomous Agent a "first-class citizen", which is the most important part.

Therefore, compared with traditional DEX, Botega is unique in the following aspects:

- Autonomous Agent at the Core: At the core of Botega is an autonomous agent system that is able to execute advanced order types and intelligently allocate liquidity without human intervention.

- AMM system based on independent processes: Botega's AMM runs as an independent process in the AO network. Each liquidity pool is like an independent server with independent data status and access rights, and can execute transactions in parallel. Because the process can be expanded, replicated and connected to unlimited network computing resources, Botega can not only support high-throughput, low-latency transactions, but also flexibly receive and process on-chain data and message requests, providing a variety of market-making models.

Botega Key Features

Botega offers a range of core features that make it a versatile and user-friendly DeFi platform. However, you should also be aware of risks during use. The Botega project is still under development, and its security and functionality are not guaranteed. There may be vulnerabilities and security risks; Botega's rules, parameters and functions may be changed or upgraded at any time.

Common DEX functions

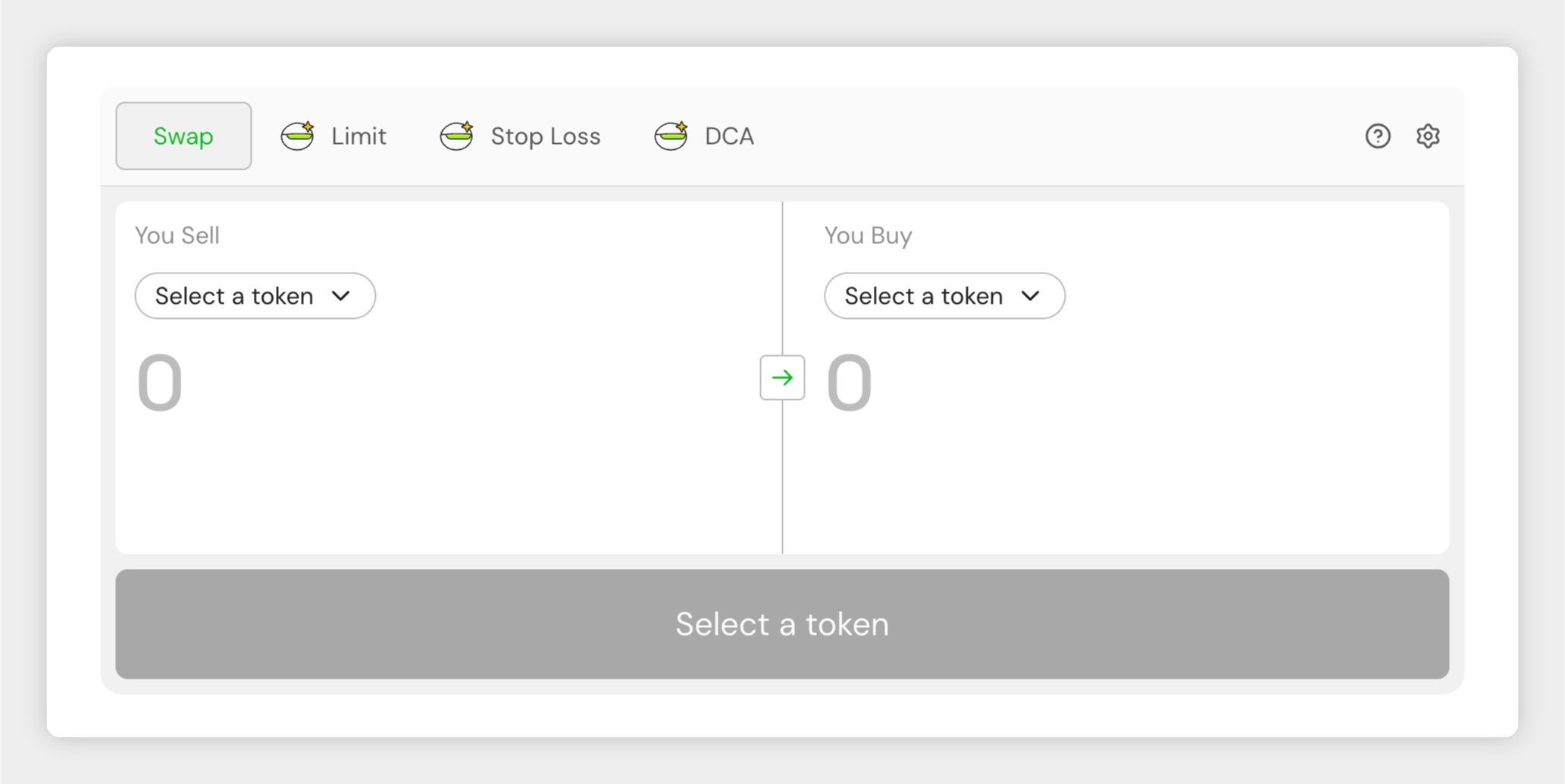

- Swap Tokens : Users can easily swap tokens on the Botega platform.

- Providing liquidity: Users can earn transaction fees by providing token pairs to the liquidity pool.

- Liquidity pool management: Users can create and manage liquidity pools and view data such as profit and loss (PNL), annualized rate of return (APY) in real time.

Advanced Order Types

Botega supports advanced order types such as Limit, Dollar Cost Averaging (DCA), and Stop Loss, driven by autonomous agents. These agents enable traders to set up trading strategies that are executed automatically.

- Limit order: Allows traders to set the price at which they want to buy or sell, and the order will only be executed when the market reaches the specified price.

- Dollar Cost Averaging: Helps traders average out entry prices by automatically executing trades at regular intervals, thereby reducing the impact of market volatility.

- Stop Loss Order: Allows traders to automatically sell tokens when certain market conditions are met.

Botega and AI: The Evolution of AgentFi

Botega's modular architecture makes it very suitable for integration with AI models. In the future, by embedding AI models into trading execution logic, Botega will achieve smarter trading decisions and personalized strategy recommendations.

- AI-driven trading strategies: AI models can analyze market data, identify trends, and execute complex trading strategies to improve trading efficiency and profitability.

- Risk Management: AI can help assess risk and implement risk management strategies such as stop-loss to minimize potential losses.

- Personalized trading experience: AI-driven agents can learn users’ trading preferences and provide personalized recommendations and strategies.

Through deep AI integration, Botega will not only be a DEX, but also an intelligent "trading assistant" in the Web3 field. It provides a high-quality experience close to that of centralized exchanges based on decentralization and transparency.

Summarize

Botega is one of the pioneers in exploring the new domain of AgentFi. Its modular design, independent scalability, parallel transaction processing capabilities, and advanced on-chain data processing capabilities all make it possible to become the next generation of DEX that breaks the circle.