RWA: Will trillion-level real assets become the next incremental engine of the crypto market?

RWA, which is regarded as the next growth engine of the crypto market, is heating up. Faced with trillions of dollars in funds, large institutions such as Binance and Goldman Sachs are making their plans.

74 articles

Gold RWA Trend Insights – Rapid Growth: From "Safe-Haven Asset" to "On-Chain Financial Infrastructure Component"

In 2025, the market capitalization of gold RWA nearly tripled, exceeding $3 billion. The market landscape shifted from a duopoly of XAUT and PAXG to a multi-functional, layered structure, with new projects expanding their differentiated paths through payment and DeFi scenarios. Institutions like DBS and Standard Chartered piloted cross-border settlements, increasing institutional participation. Macroeconomic uncertainties drove up gold prices, leading to increased demand for "on-chain gold" in value storage, payments, clearing, collateral, and cross-border settlements. With the maturation of next-generation financial infrastructure, gold RWA is poised to become a key underlying asset, but it still faces risks related to centralization, transparency, and technology.RWA Power Map: A Comprehensive Guide to How Five Major Agreements "Divide" Trillions of Institutional Capital

The institutional-grade RWA tokenization market is worth nearly $20 billion. Five major protocols—Rayls, Ondo, Centrifuge, Canton, and Polymesh—are driving the on-chain migration of trillions of dollars in assets, addressing the needs of bank privacy, retail distribution, asset management, Wall Street settlement, and securities compliance, respectively.The tug-of-war between two paths behind the tokenization of DTCC in the US stock market: the debate between DTCC's "improvement" and crypto-native "revolution".

DTCC's approval to tokenize security interests upgrades the efficiency of the existing system; direct holding of tokenized shares challenges the intermediary structure. These two paths reveal different futures for security tokenization, and the market will determine which model is superior.Interview with GAIB founder Kony: Breaking the "capital dilemma" of AI infrastructure, how does GAIB turn GPUs and robots into income-generating assets in the DeFi world?

GAIB tokenizes AI infrastructure (GPUs, robots), building an RWA×AI×DeFi model. A TGE will be held on November 19th, and its token will combine governance and cybersecurity features. The AI Dollar stablecoin will integrate the yields of all tokenized AI assets.Video

BlackRock CEO's annual letter to investors: Bitcoin may challenge the global status of the US dollar, and tokenization is the future financial highway

BlackRock CEO Larry Fink released his annual letter to investors, posing a thought-provoking question: “Will Bitcoin undermine the dollar’s reserve currency status?” He also said that tokenization is becoming a key force in reshaping financial infrastructure.

RWA track development acceleration: from new public chain Converge to Sky competition, BUIDL fund has exceeded 1 billion US dollars

The total value of on-chain real-world assets (RWA) has reached $19.53 billion, up 19.58% in the past 30 days. The RWA track has seen a number of key developments, covering public chain innovation, tokenization competition, mortgage-backed securities market, and real estate tokenization. In this article, PANews will briefly sort out and introduce these developments.

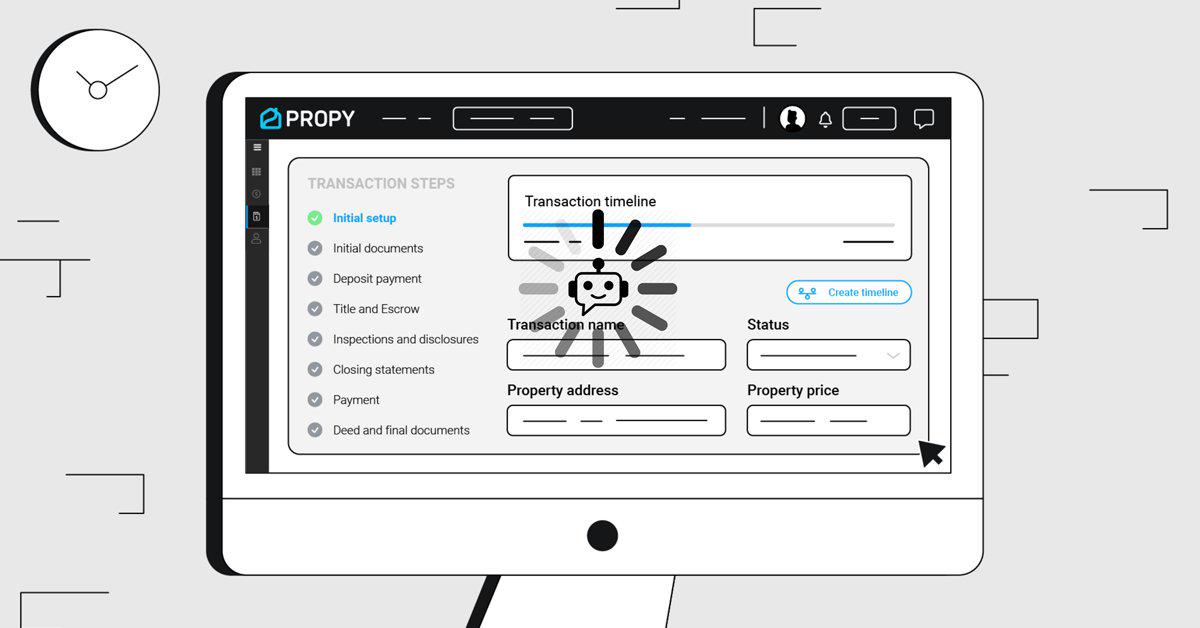

When AI meets RWA, how can on-chain real estate Propy create an efficient disintermediation model under the trend of artificial intelligence?

RWA is bringing more possibilities to the crypto world. At the same time, artificial intelligence and RWA are also being organically combined. Propy uses artificial intelligence technology and has become a typical case worthy of attention for the combination of the two technologies.

Aave proposed a new plan, Horizon, to launch RWA products. The community was in an uproar, and the founder responded urgently...

Within days of the proposal being released, the community expressed strong opposition to the Horizon plan, especially questioning the potential issuance of new tokens and Horizon’s profit distribution mechanism.

With a 64-fold increase in one year, what actions has MANTRA, the L1 project of the RWA track, taken?

In the RWA track, MANTRA (OM) has been active in the past year and will launch the mainnet in October 2024. On January 9, MANTRA announced that it had reached an agreement with the Dubai-based real estate group DAMAC Group to tokenize at least $1 billion of the group's assets in the UAE.

An article explaining OpenEden in detail: Binance invests in RWA, a new option for U.S. debt investment

With strategic investment from Binance in September, OpenEden has taken an innovative path in the RWA field. It focuses on the U.S. Treasury bond on-chain and opens up new paths for investors. Its product OpenEden TBill Vault allows USDC holders to easily participate in U.S. Treasury bond investment; with the support of Moody's "A" rating, the TVL exceeds 125 million US dollars and attracts many institutional clients. How it will shine in the RWA market after Binance's investment is worthy of investors' attention.