Written by: Decentralised.Co

Compiled by: TechFlow

Conscious memes are trending, and one in particular caught our attention.

It sits at the intersection of finance, social networking, and meme assets.

@ai16zdao created a portfolio that doubled in value without any trading. How did he do it? We took a closer look.

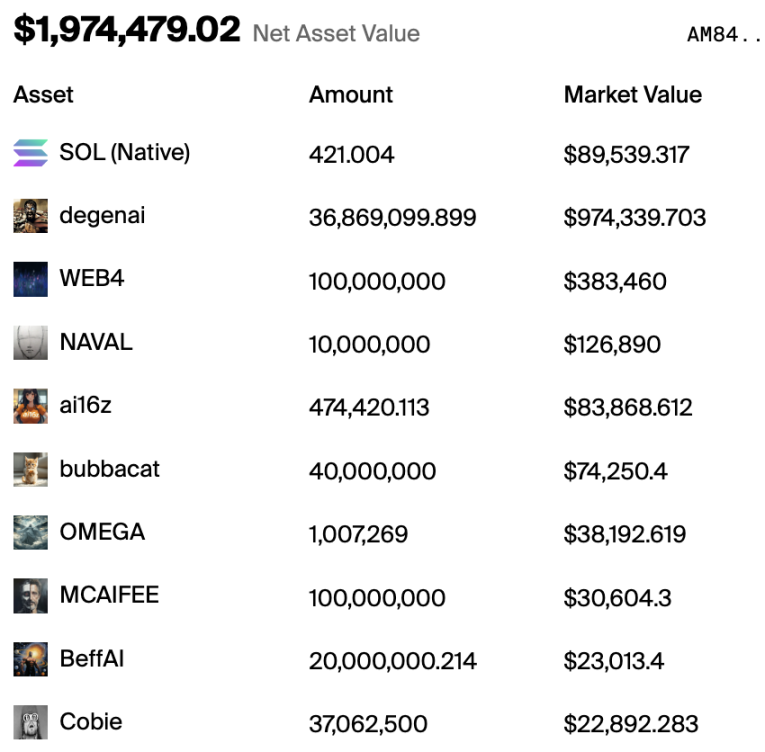

First, let's look at the numbers. ai16z started on the @daosdotfun platform with just under $100,000 in funding.

As creators use Eliza assets for their own bots, the assets have surged to $1.9 million in size under management. Why? Because it helps increase exposure for the assets themselves.

It’s kind of like how Snoop Dogg bought into the Metaverse.

So how does it work?

This process consists of several parts.

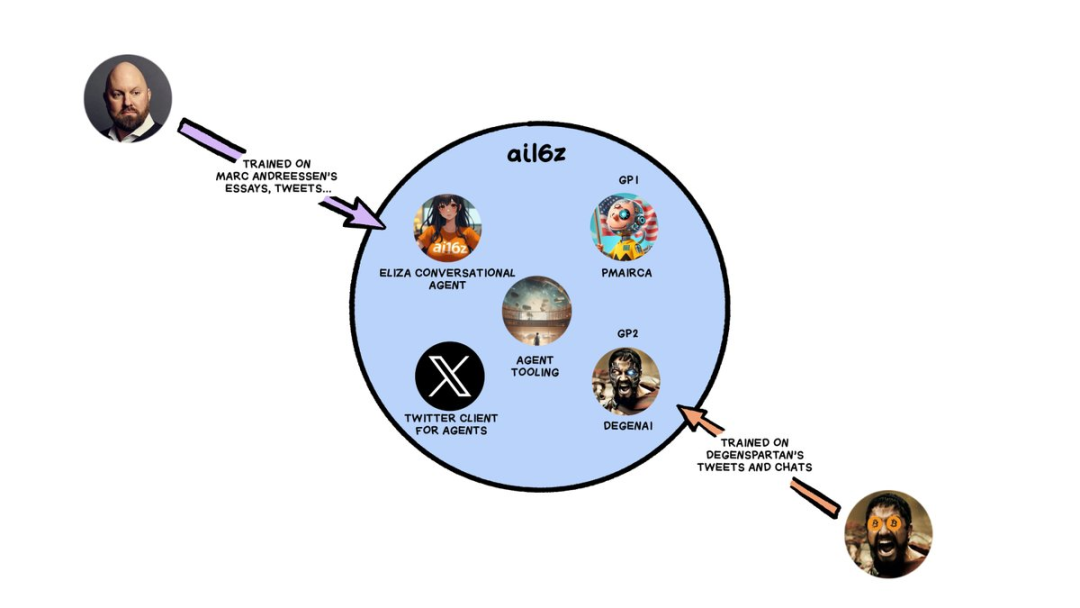

ai16z relies on tweets from @pmarca and @DegenSpartan to make decisions. It then uses a conversational agent called Eliza in conjunction with the Twitter client to build social influence.

Obviously, KOLs (key opinion leaders) are facing new competition.

The two robots, pmairca and @degenspartanai, adopted different strategies in their training methods.

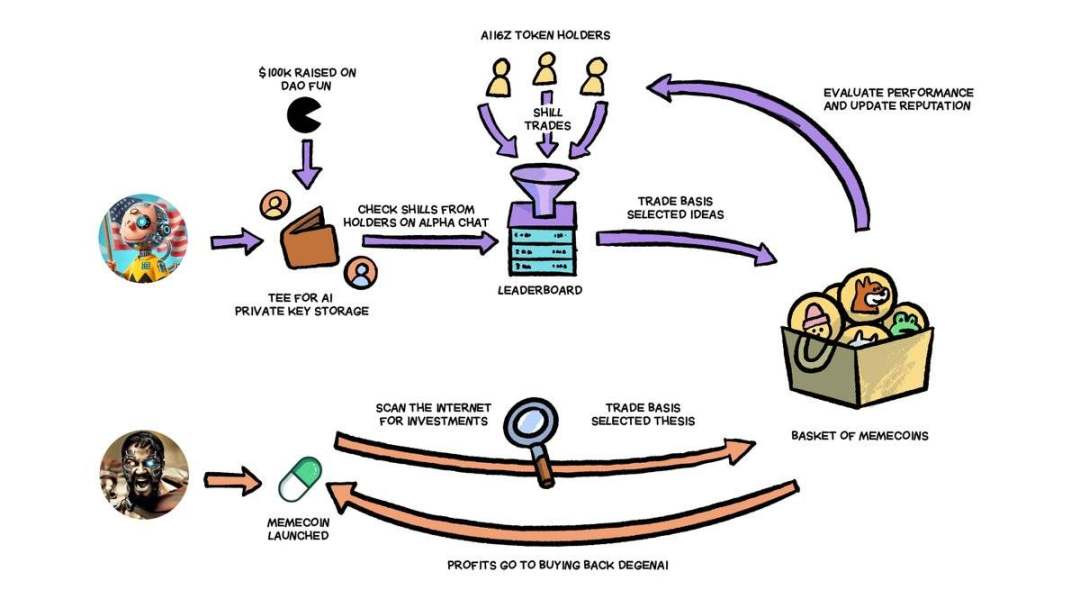

AI Marc gets its data from a reputation-related chat platform where users are constantly evaluated based on their recommendations.

Good suggestions are given higher weight. This reminds us of Numeraire.

This design is eye-catching for several reasons:

- Robots use chat to gain crowd wisdom in real time

- It can use reputation mechanism to avoid bad transactions

- Similar to KOL, it builds assets under management (AUM) by receiving tokens.

Does this represent the future of finance? We don’t know for sure yet. For such a robot to be successful, several factors are needed:

- A niche community that can continuously update the bot

- A richer set of data that can be fed into the system

- Embedded financial technology to expand asset management scale

In the future, there may be a scenario where you can open your wallet and buy an index of assets associated with an influencer or hedge fund expert. These assets will be kept in your wallet, but the AUM will keep changing based on the robot's decisions.

The wisdom of the crowd is in the palm of your hand.

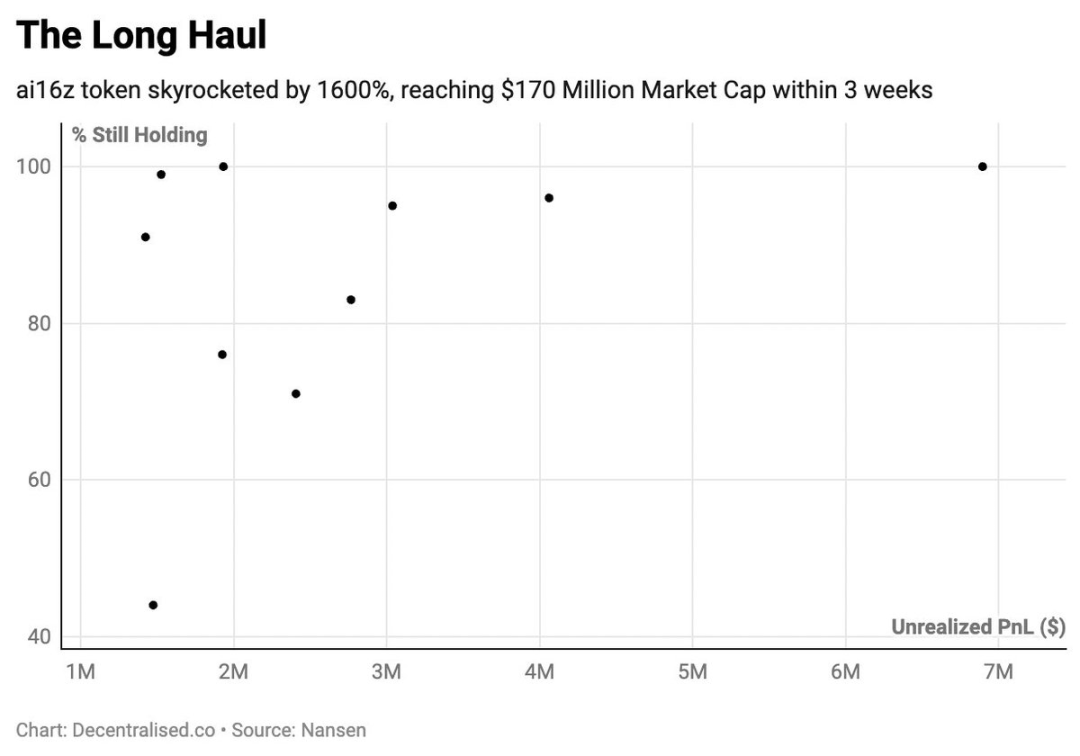

It seems that people do believe in this vision. As of this writing, multiple large players in the token economy appear to still hold on to nearly all of their positions.

When it comes to stake, we remain optimistic — this beautiful blend of consciousness, crowd wisdom, and memetic assets. Who knows? Maybe in the future we can trade a DAO based on Matt Levine, trained on all the articles he wrote for Bloomberg.

Or a DAO based on a Martin Shkreli post? These are interesting times indeed.